WeChat or Weixin?

The apps distinguish their functions based on the account’s region, with the deciding factor being the user’s mobile phone number.

Accounts tied to a mainland China phone number can access Weixin, while those with an overseas phone number can use WeChat.

What documents do I need to set up and to be able to use a WeChat Pay account?

- People’s Republic of China (PRC) Passport or PRC Foreign Permanent Resident ID Card

- Mainland travel permit or residence permit for Hong Kong SAR, Macau SAR and Taiwan residents

- You can use your international phone number as long as it can receive an SMS verification code.

- Having a referral from a verified WeChat user can facilitate the setup process. This can be a significant hurdle for foreign users who do not have contacts in China.

How to set up WeChat Pay foreign credit card and how to use it to pay?

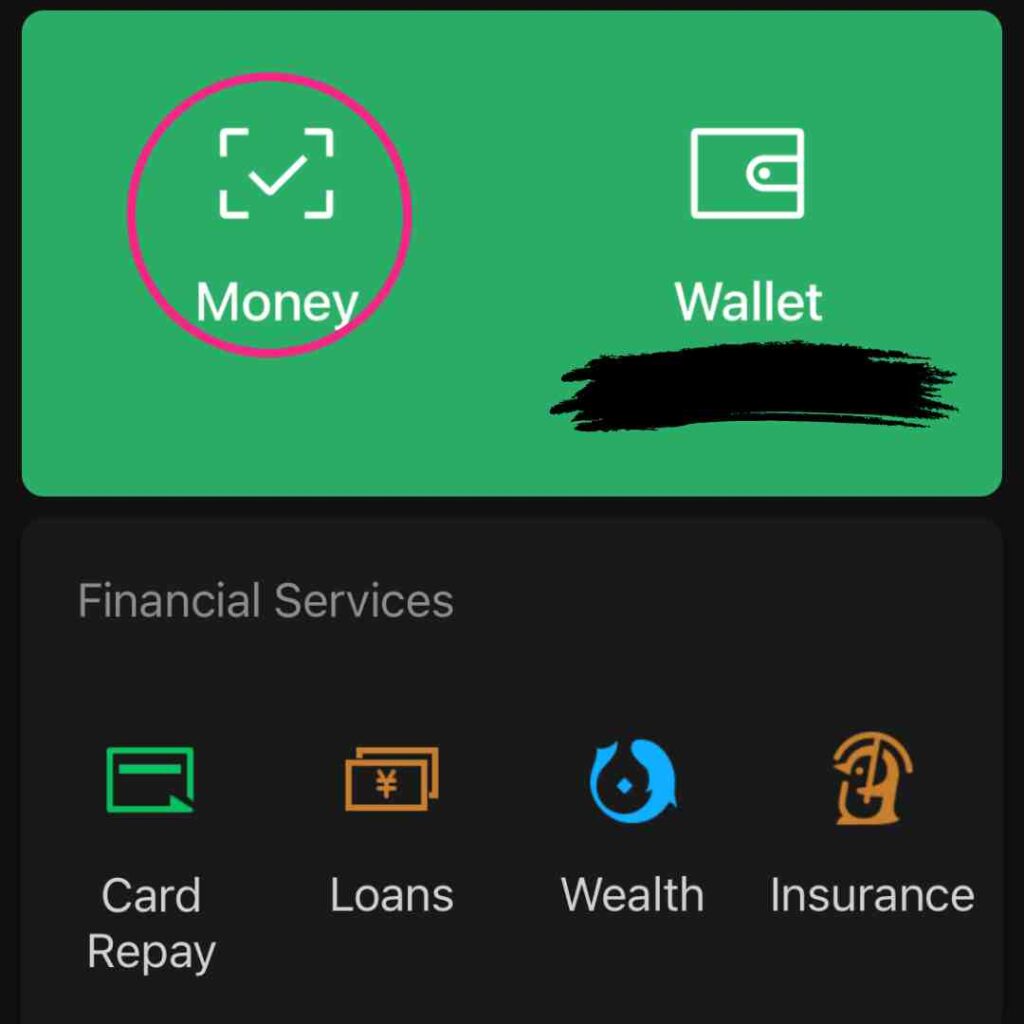

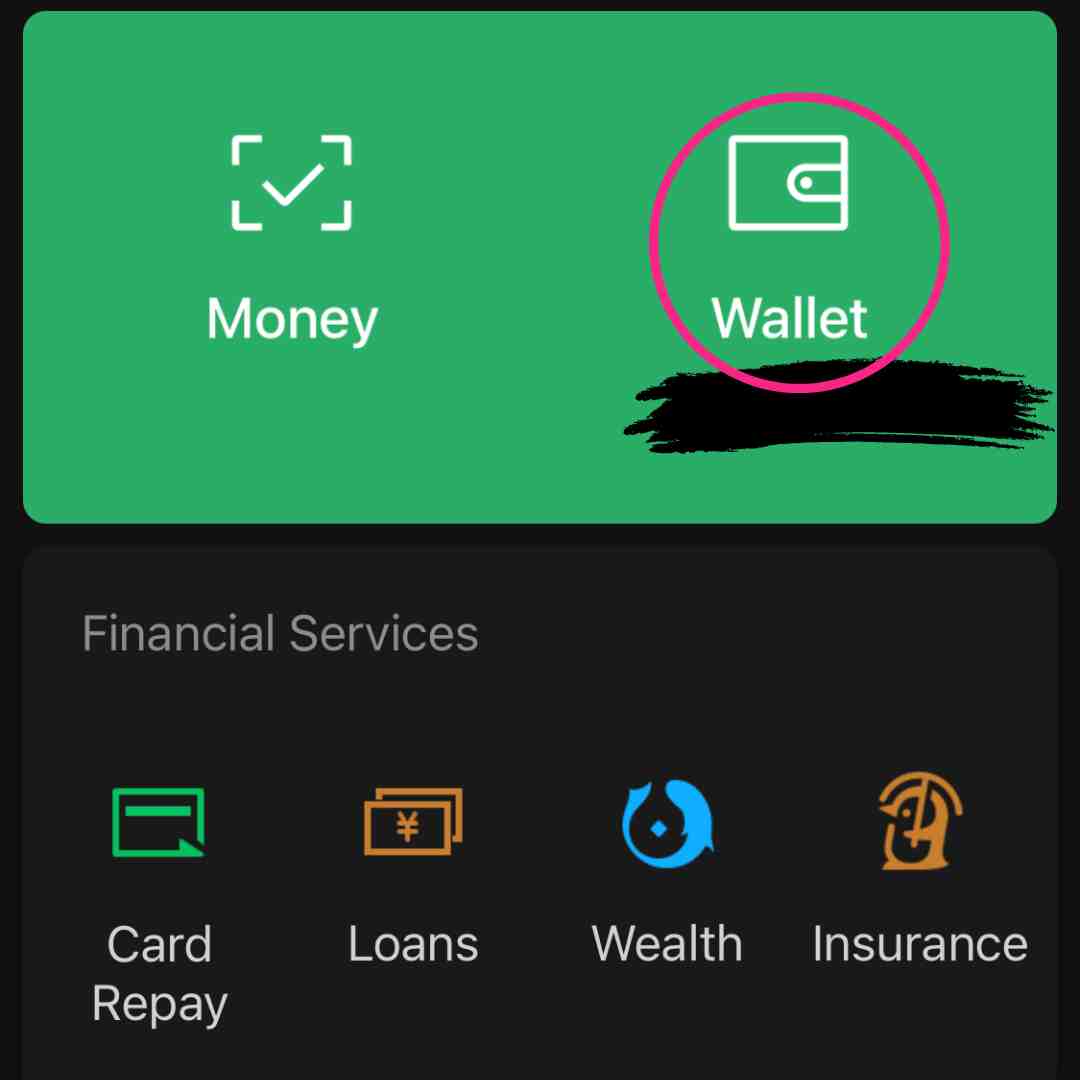

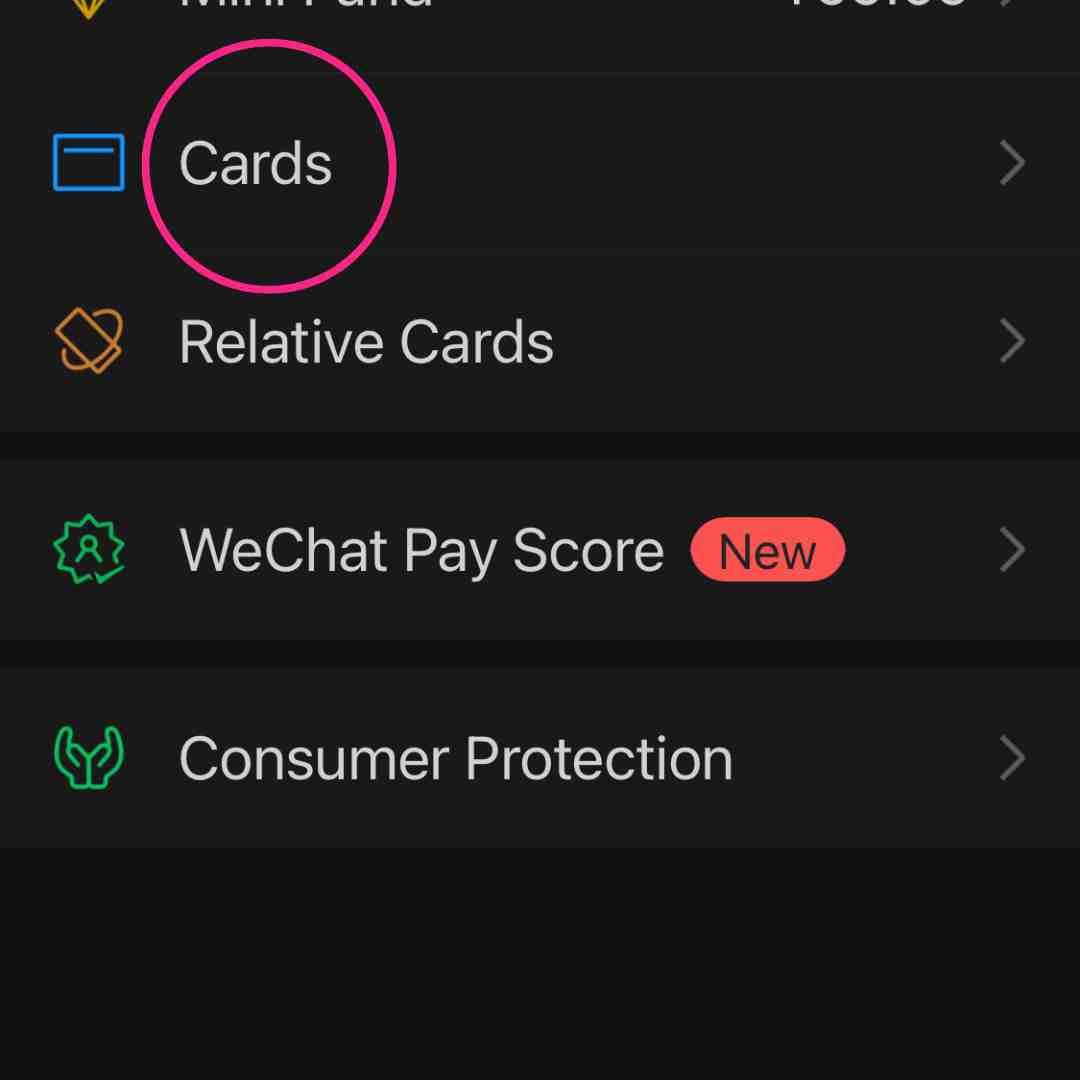

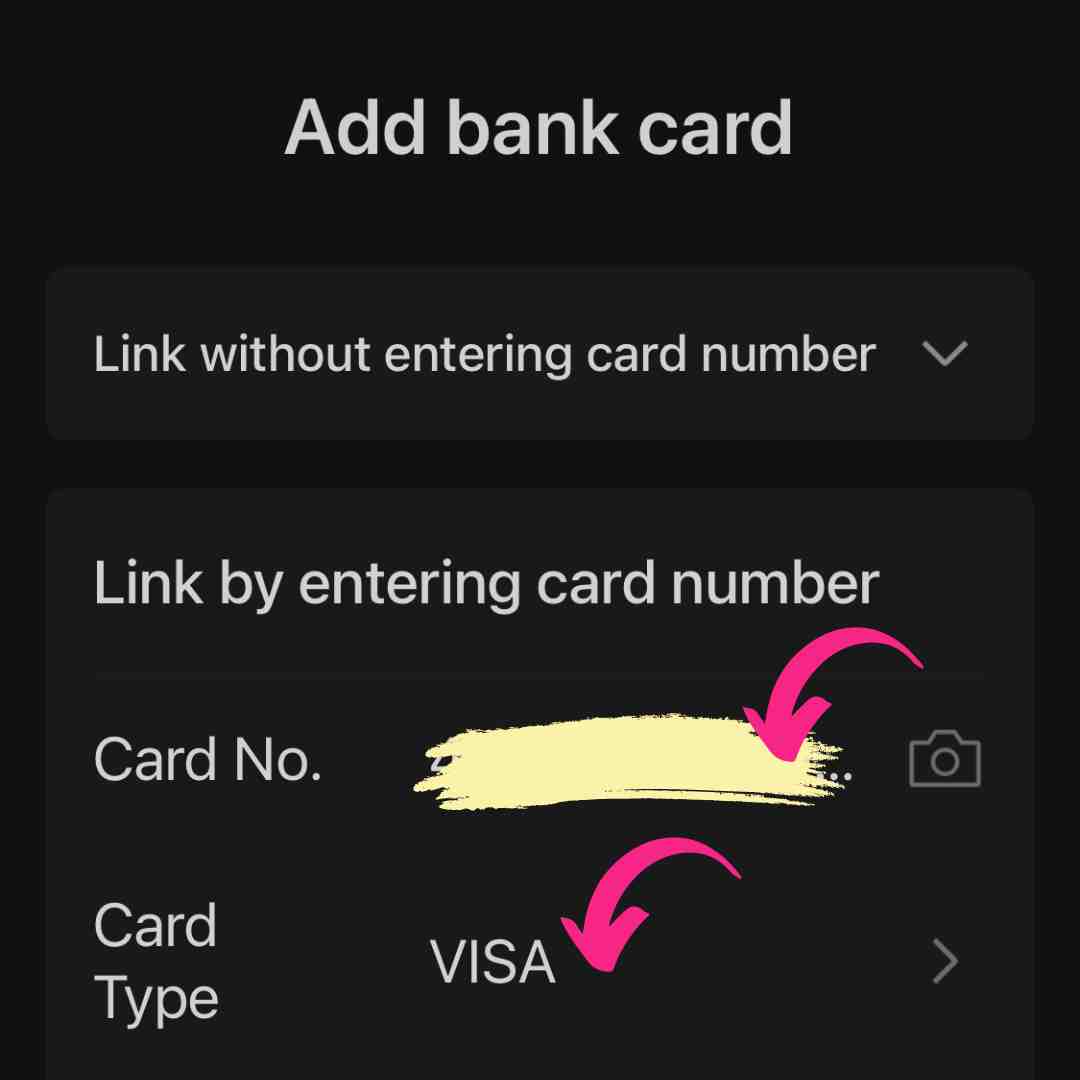

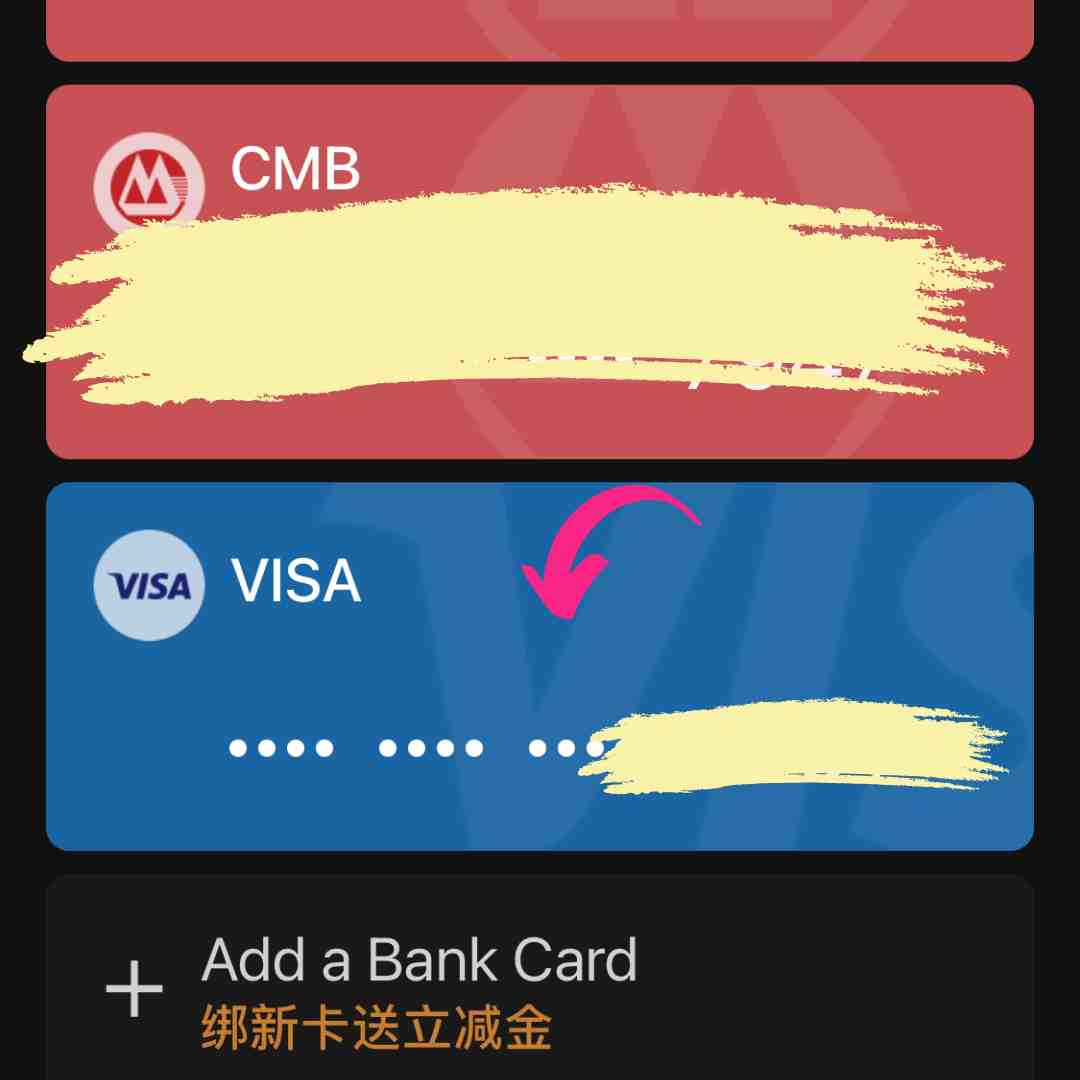

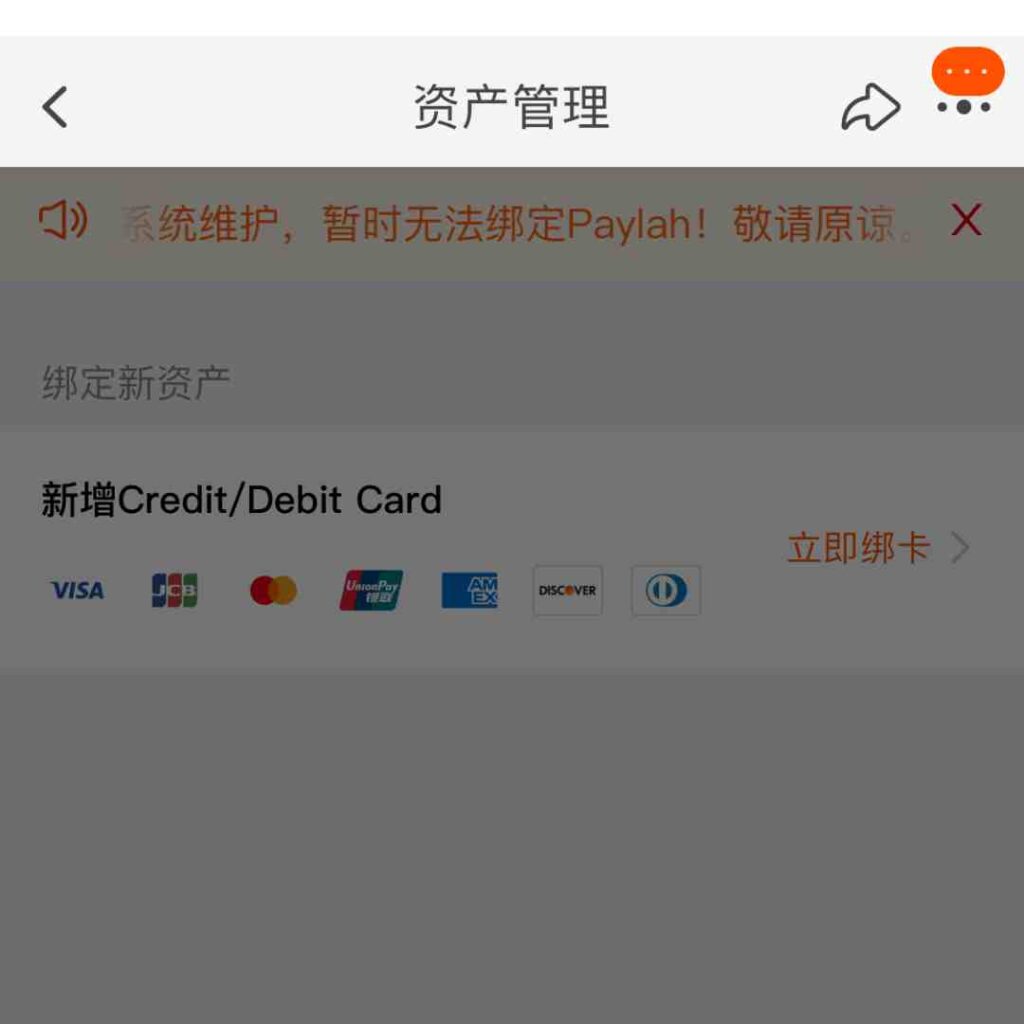

- Open your wallet, click your cards, and add cards by fill in card information:

You can use any supported debit/credit card above. But here, I use a Revolut virtual debit card for security reasons when I travel overseas. It is an efficient and safe way to top up money from your local debit card. Moreover, it offers an additional layer of security for online transactions, especially in foreign countries.

- Card verification is successful and the card is added:

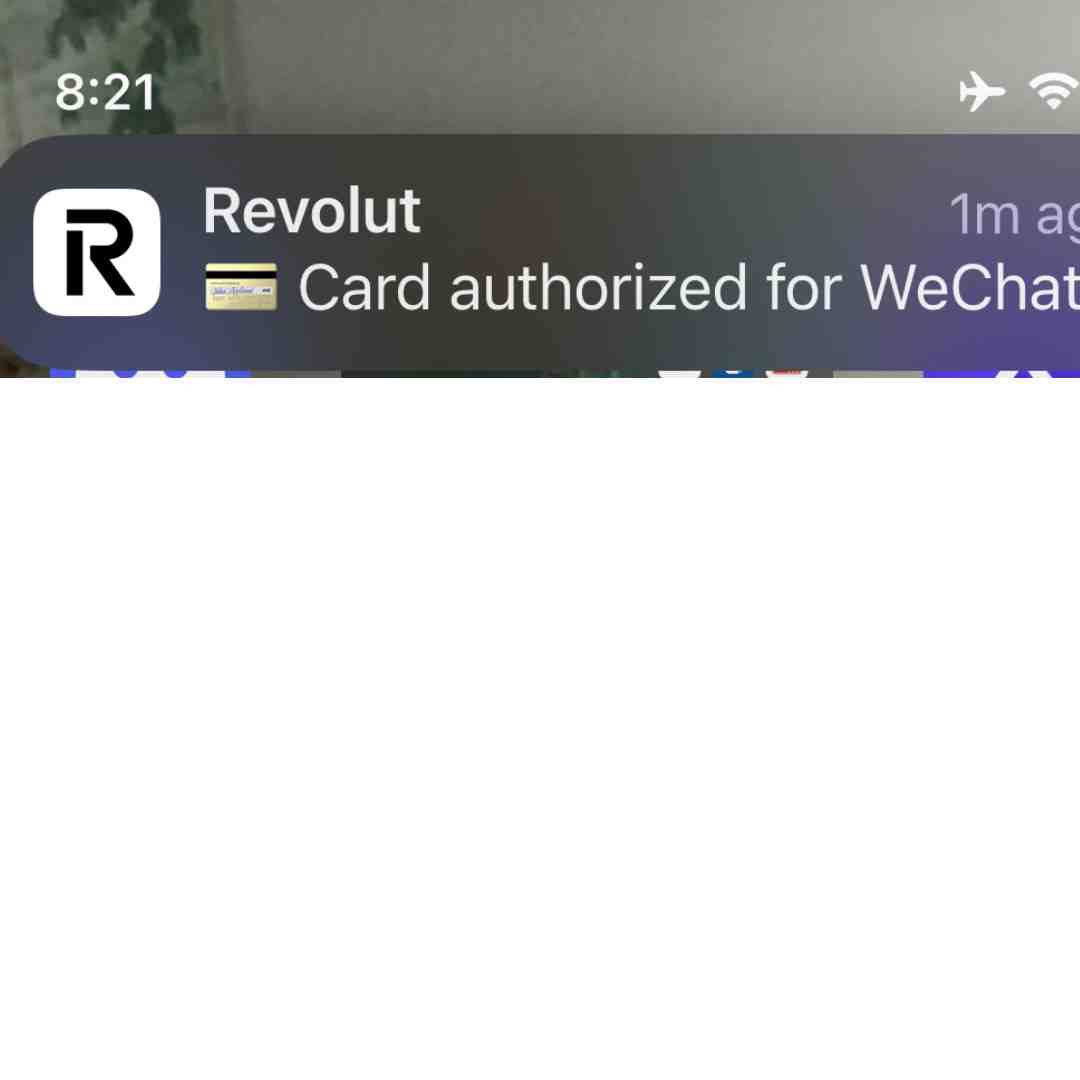

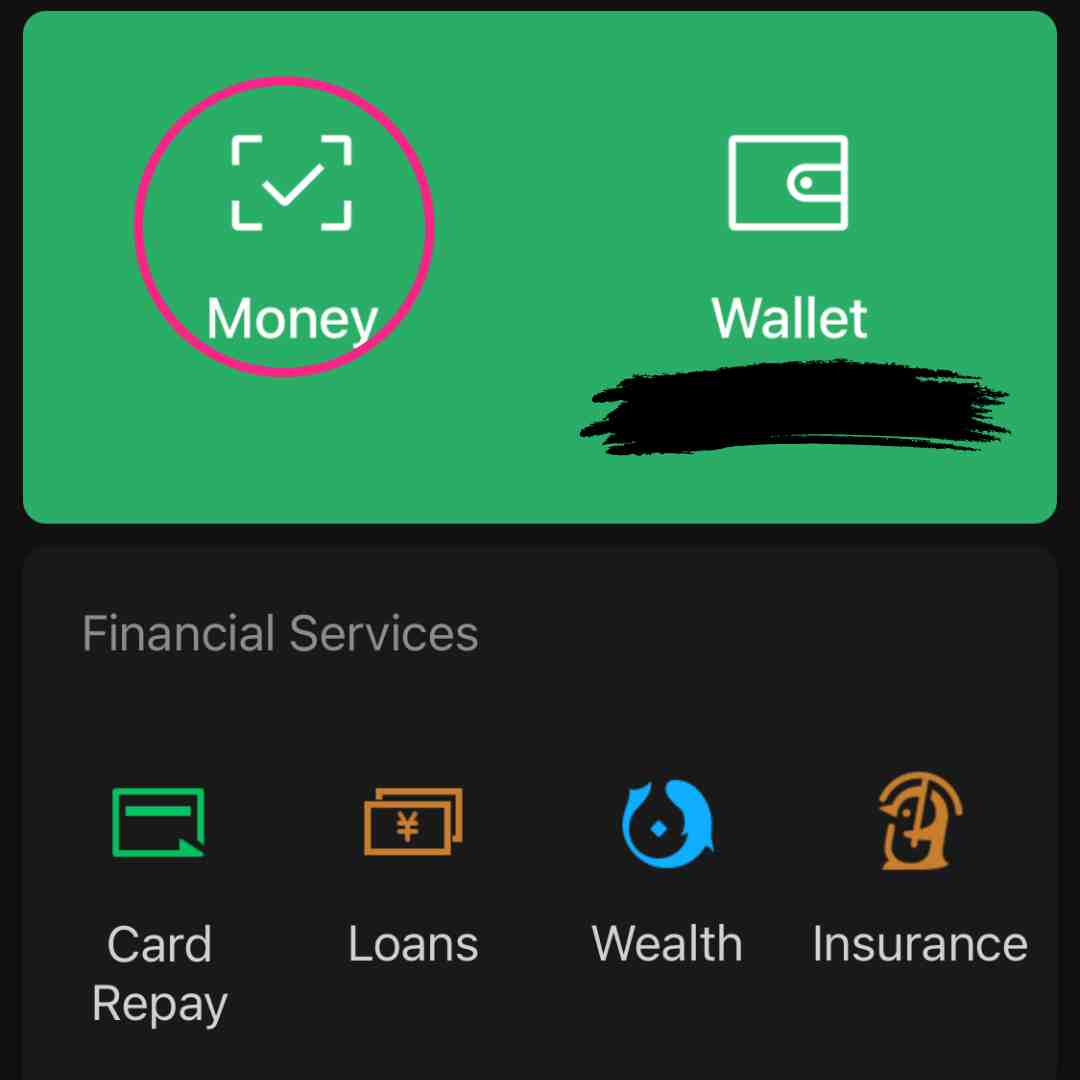

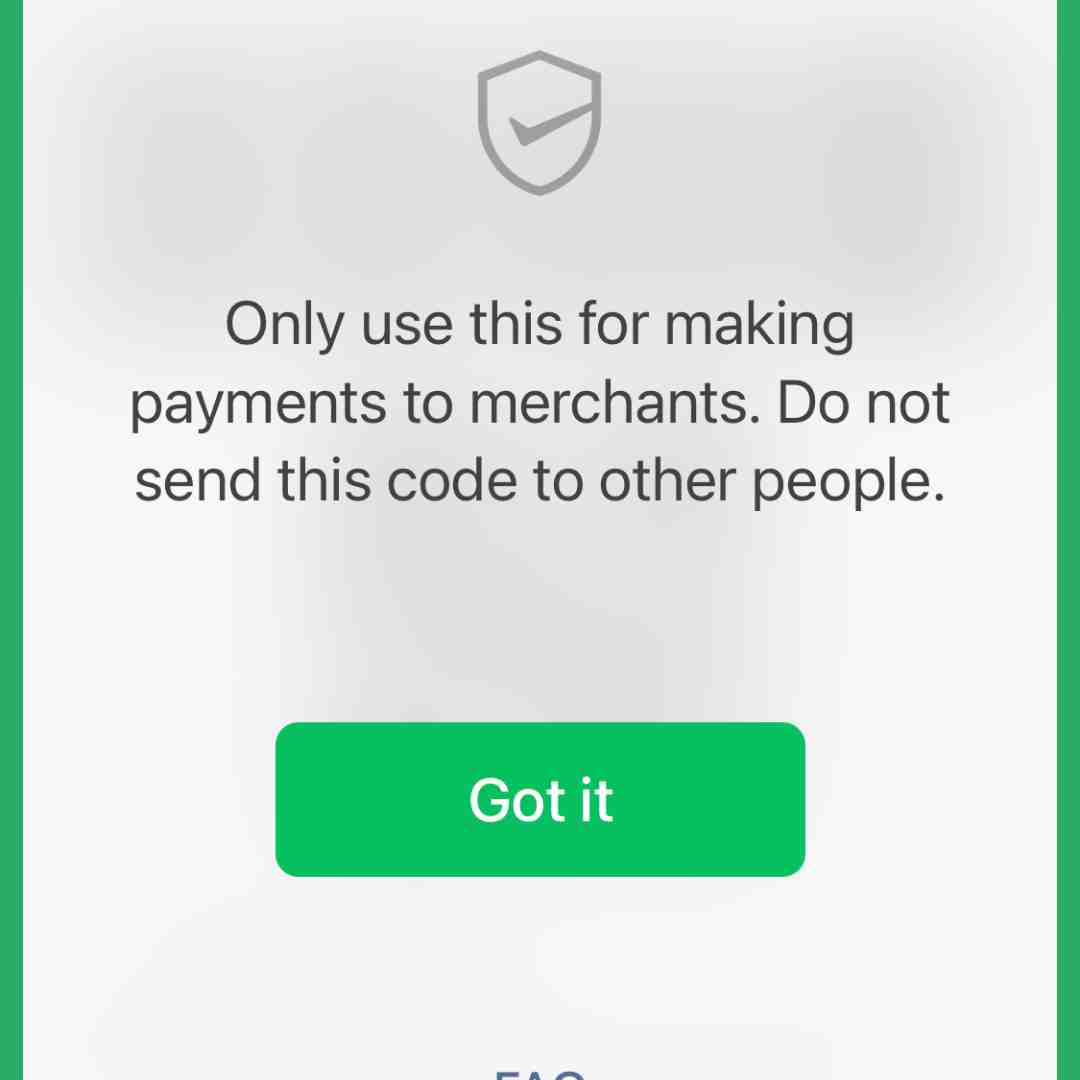

- Open you Money, and show your payment QR code to the merchant, the merchant scans your QR code (or you can also scan the merchant’s QR code if they only provide their receive code), my Revolut send me payment notification instantly:

and this is a very small grocery merchant on the street:

What kind of transactions does WeChat Pay support for international cards?

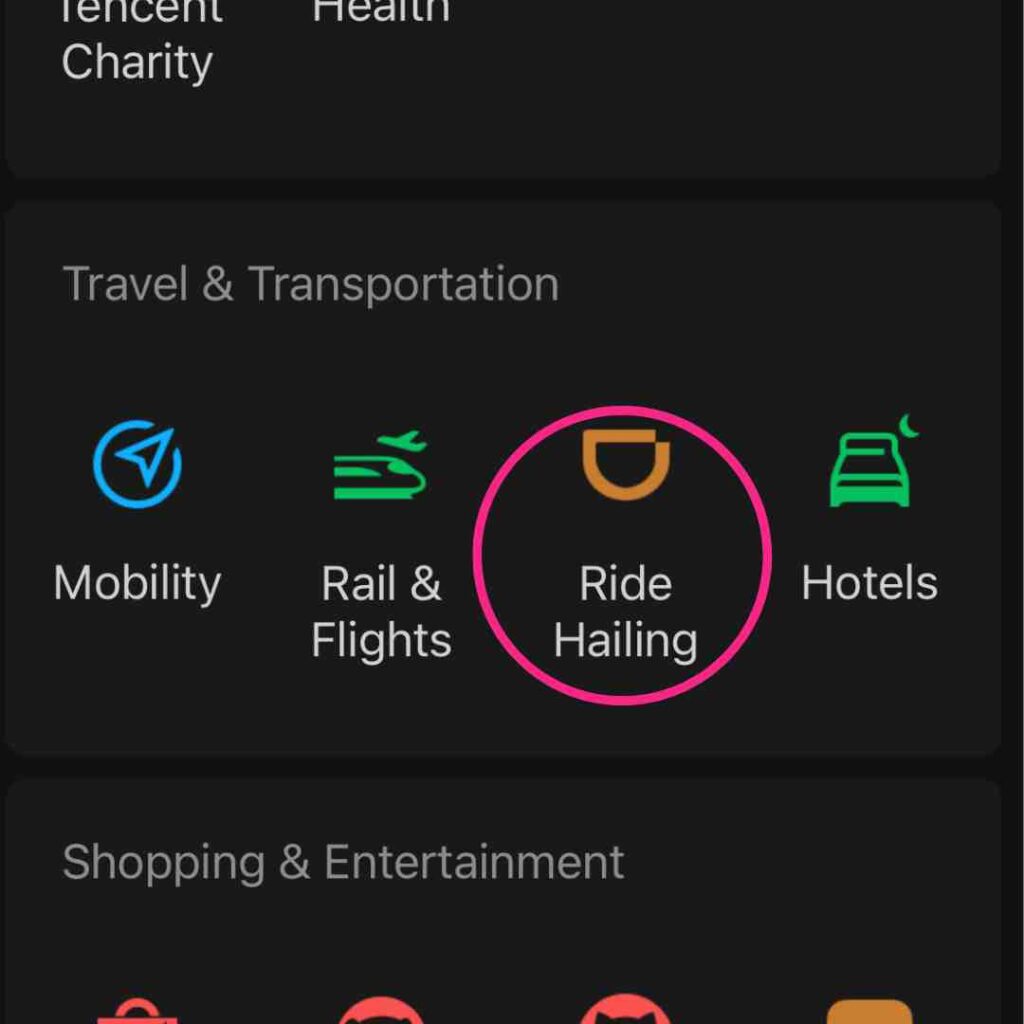

It works for mobile payments: for example, foreign users can use their overseas bank cards link to the WeChat app for payments on Pinduoduo and Didi, and you can also use WeChat Pay to pay on JD.com by selecting the credit card option. Buying airplane tickets and train tickets is also very convenient with WeChat service — open Service -> Travel & Transportation:

Taobao supports overseas mobile payments. You can pay on Taobao either via Alipay (which can be linked to an international card) or adding overseas credit/debit card:

However, there are alternatives. For instance, Alipay, one of the popular mobile payment solutions in mainland China, allows both local and foreign users to link their debit/credit card for purchases.

While you may not be able to top up your account balance or send money to friends, you can still use it for purchases in shops or for services like DiDi, a popular ride-hailing app in China. Check out our personal test on Alipay payment in two small street vendors.

It is advisable to explore other payment options or consider opening a Chinese bank account if you plan to stay in China for an extended period.

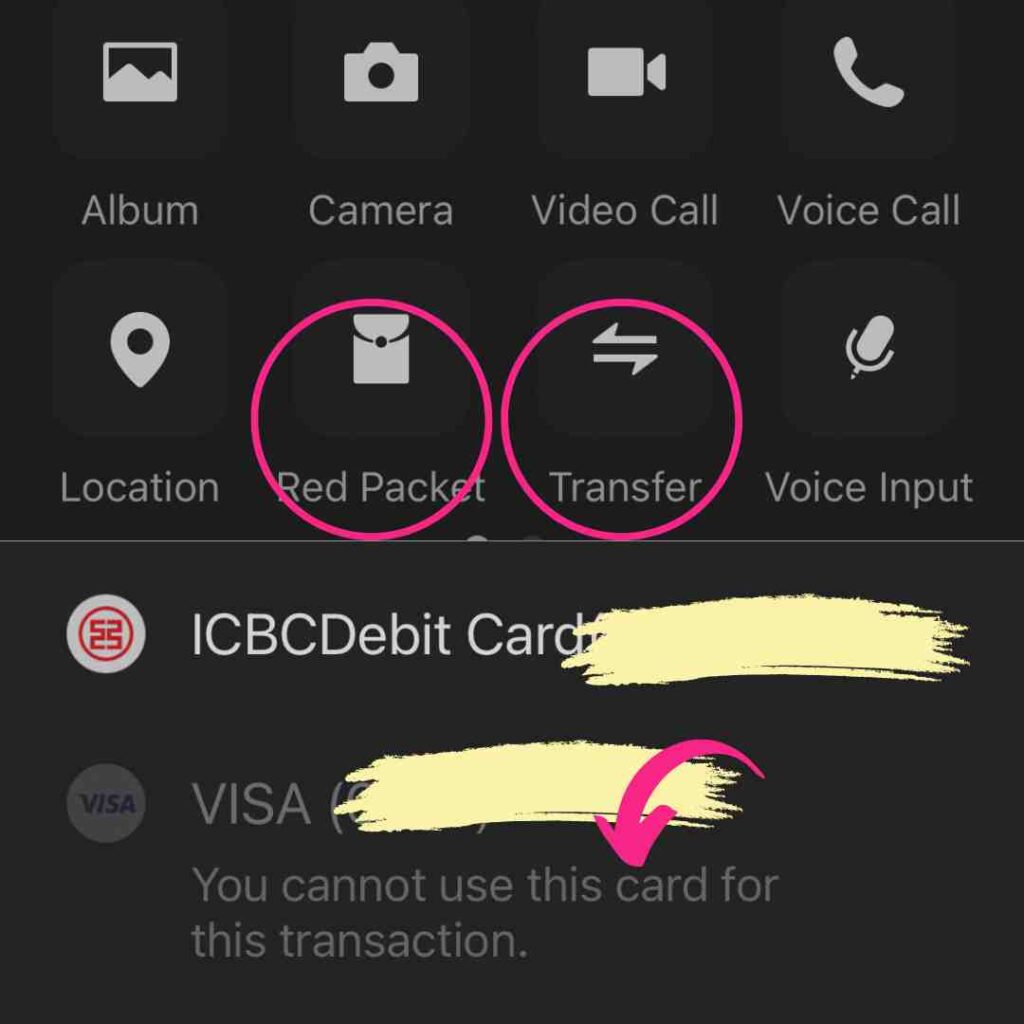

International cards do not support red packets and money transfers:

For offline payments using overseas credit card, it depends on the vendor. There is no problem with 5-star hotels, DiDi, or 12306 for train tickets; however, although a small number of domestic vendors accept foreign credit cards, most don’t accept Visa or Mastercard credit cards, so it may fail when you use WeChat Pay with an international credit card.

Are there any transaction fees?

Yes, transaction fees are waived for single transactions under 200RMB. A 3% transaction fee will be applied for single transactions above 200 RMB. Transaction fees are reimbursed in proportion to the refunded amount if a refund for transactions is requested.

Is there a transaction limit? How is the exchange rate calculated?

There is a limit of 6000 RMB for single transactions, a cumulative limit of 50000 RMB for monthly transactions, and a cumulative limit of 60000 RMB for yearly transactions. The exchange rate will be based on the exchange rate of the card organization and the issuing bank of your international card.