Alipay, the eWallet mobile app that’s a hit among loacals, it not only supports Chinese bank account, is now also open to foreign visitors.

Alipay payments supports international credit cards (and some other payment methods); you can link your alipay account to your foreign credit or bank card without real-name verification and a Chinese phone number.

It also offers a ‘tour card’ program that gives foreigners access to the app for 90 days (warning: many users cannot receive verification code to register tour card by the phone number they provide, if you come across the same situation, ignore ‘tour card’ section).

This article is your one-stop guide to understanding how you can utilize this breakthrough, I personally tested Alipay mobile payment on 3/17/2024, and it worked perfectly!

Once you set things up, Alipay can be your financial companion during your stay in China, making transactions as easy as a tap on your phone.

Binding International Credit/Debit Card to Alipay

- Download Alipay from the app or google store, then register with your mobile number. Of course, you can also register using your email and Apple account.

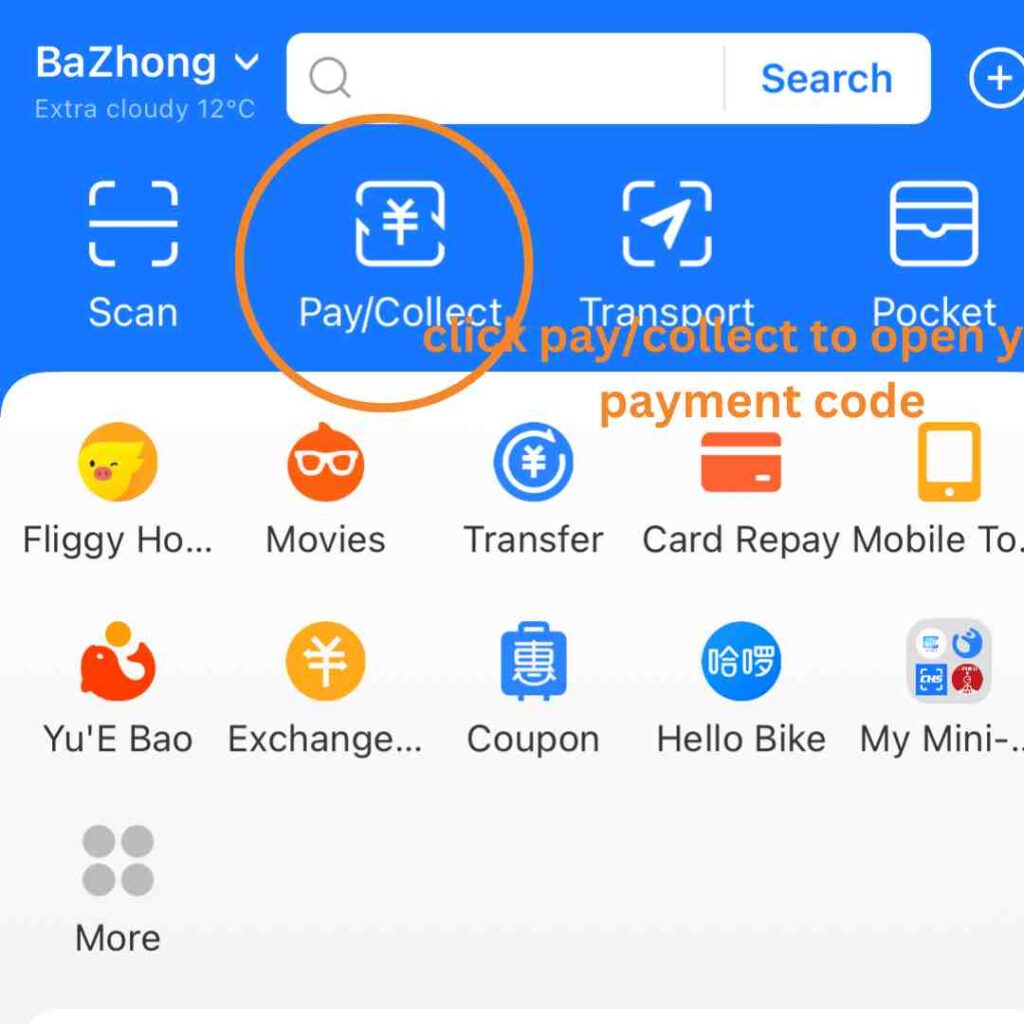

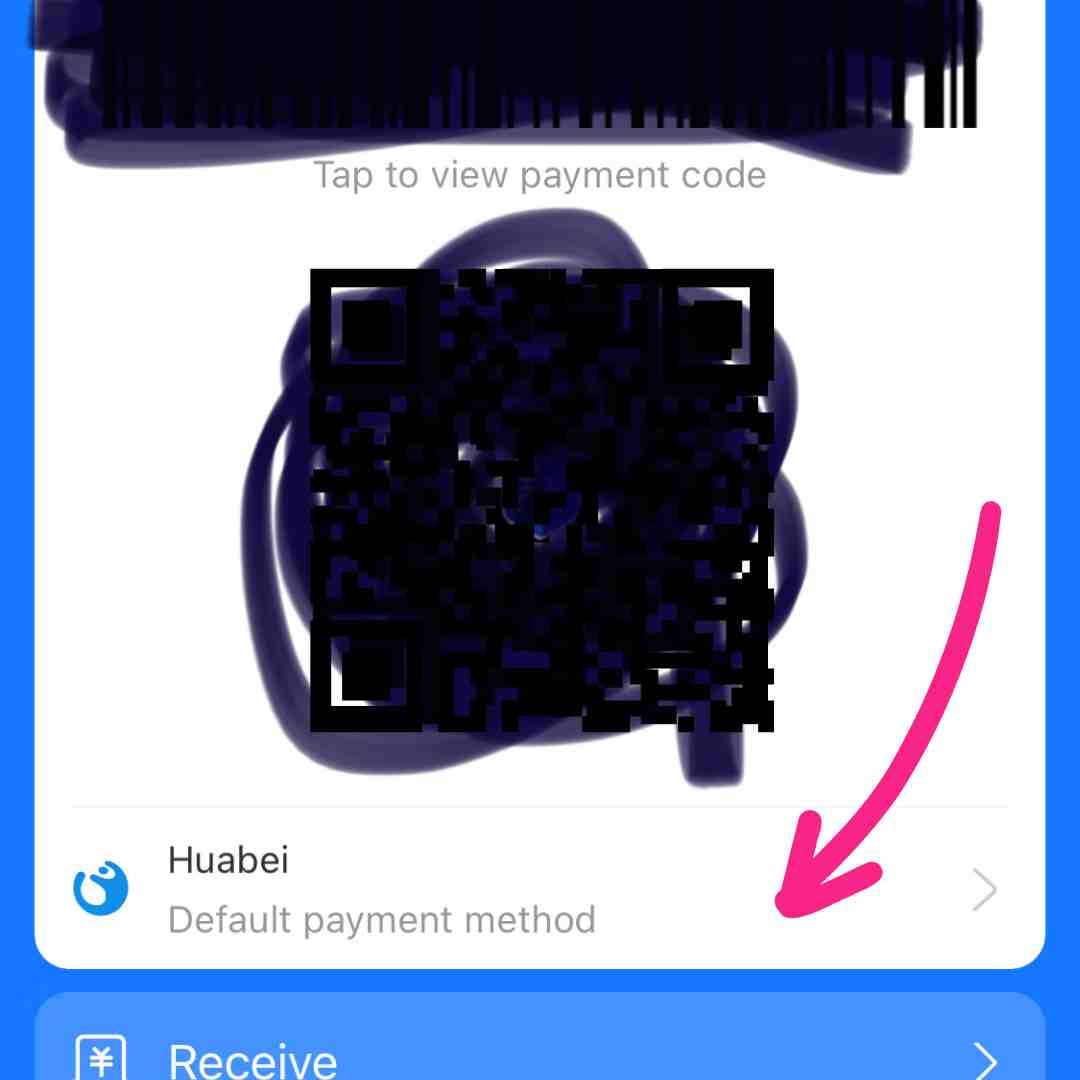

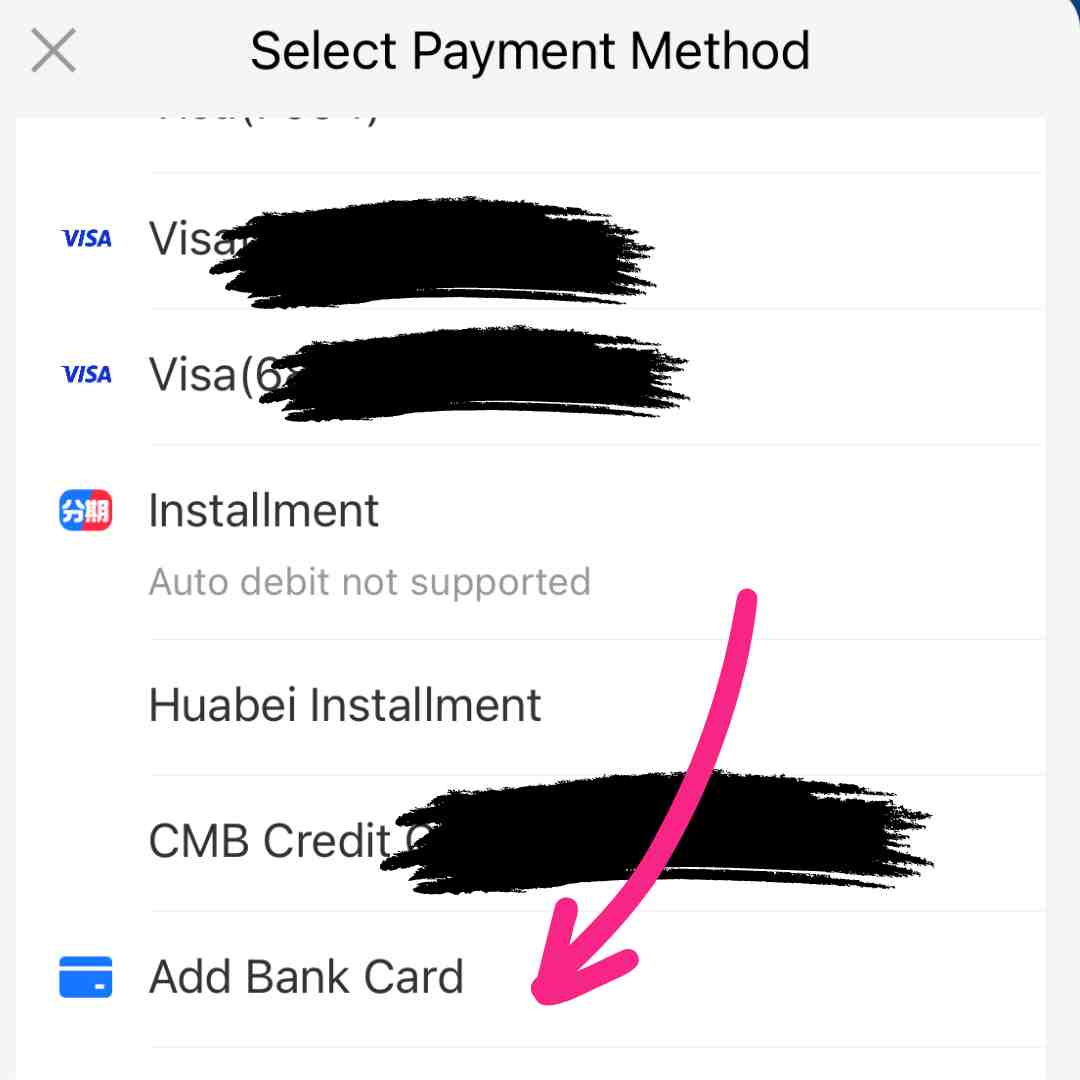

- After signing up Alipay, open ‘Pay/Receive’, you will see your payment QR code; click default payment method, scroll down to the bottom and click ‘Add Bank’ Card

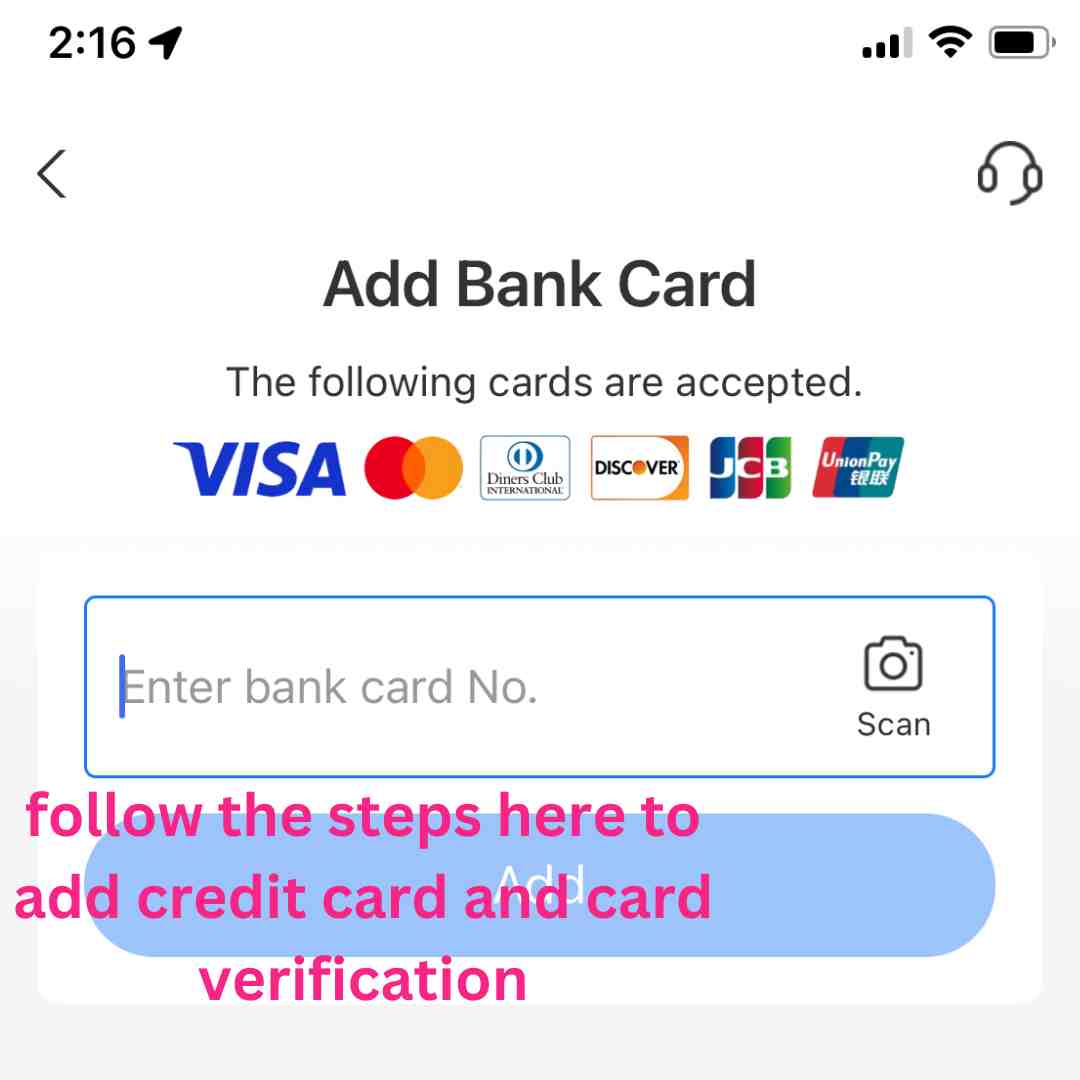

- Bind a bank card in Alipay, which support international bank cards issued by all major international card networks:

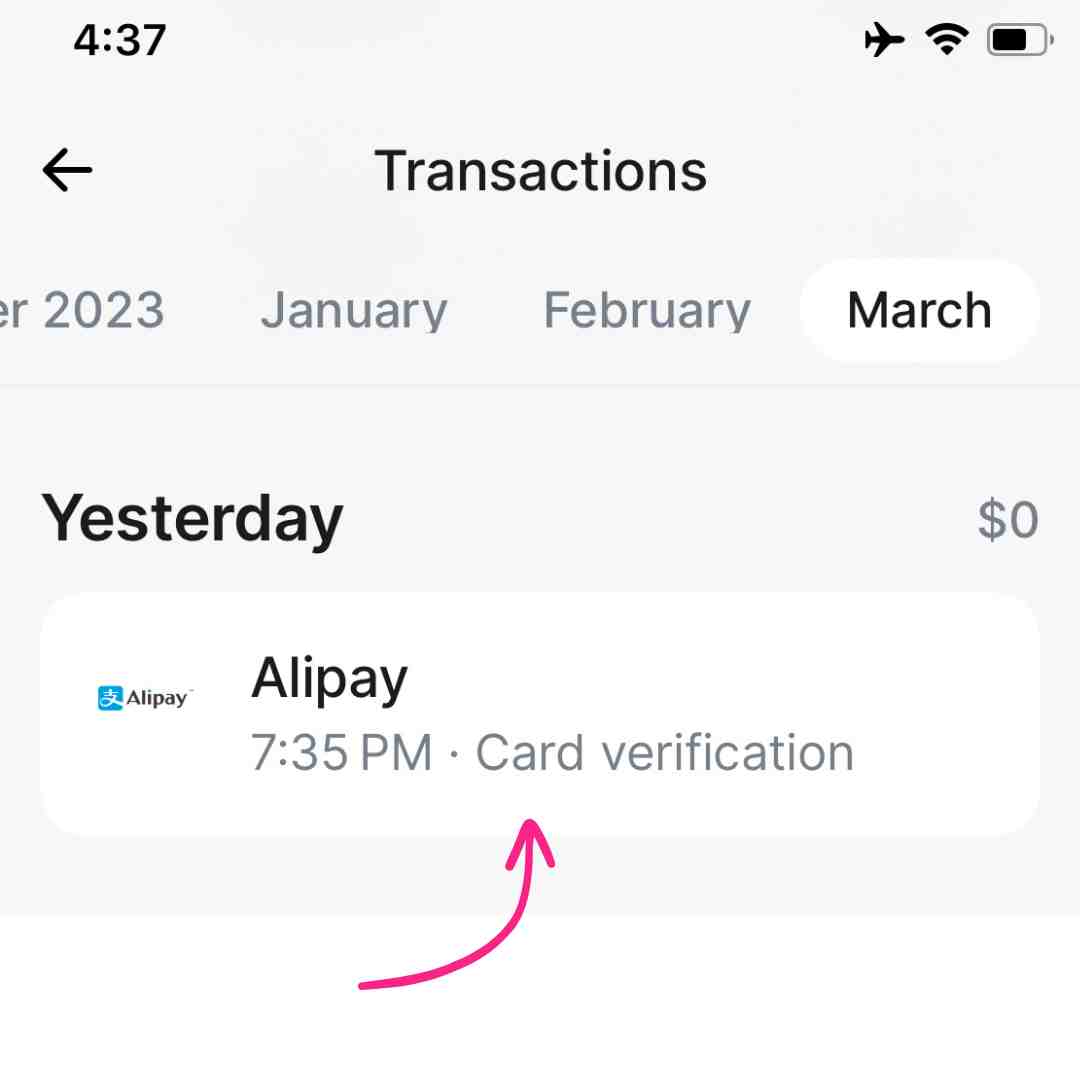

- You can use any supported debit/credit card above. But here, I use a Revolut virtual debit card for security reasons when I travel overseas. Revolut offers better foreign exchange rate in working hours (1,000 USD/month no-fee, then 0.5% fair usage fee) and an additional layer of security for online transactions, especially in foreign countries, to prevent from fraudulent charges. Here is the verification in Alipay using Revolut virtual debit card:

Alipay for Foreigners: How to Pay for Things

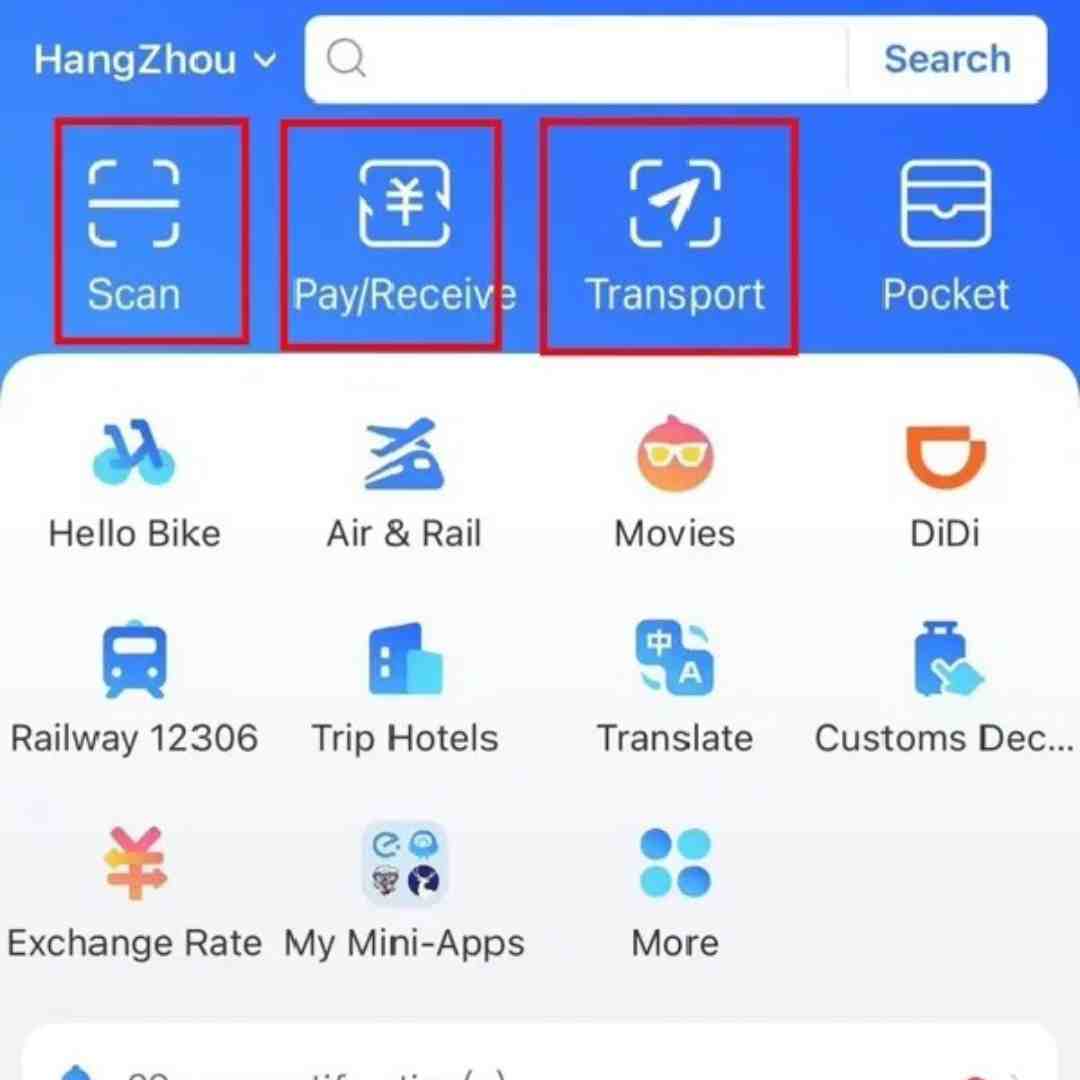

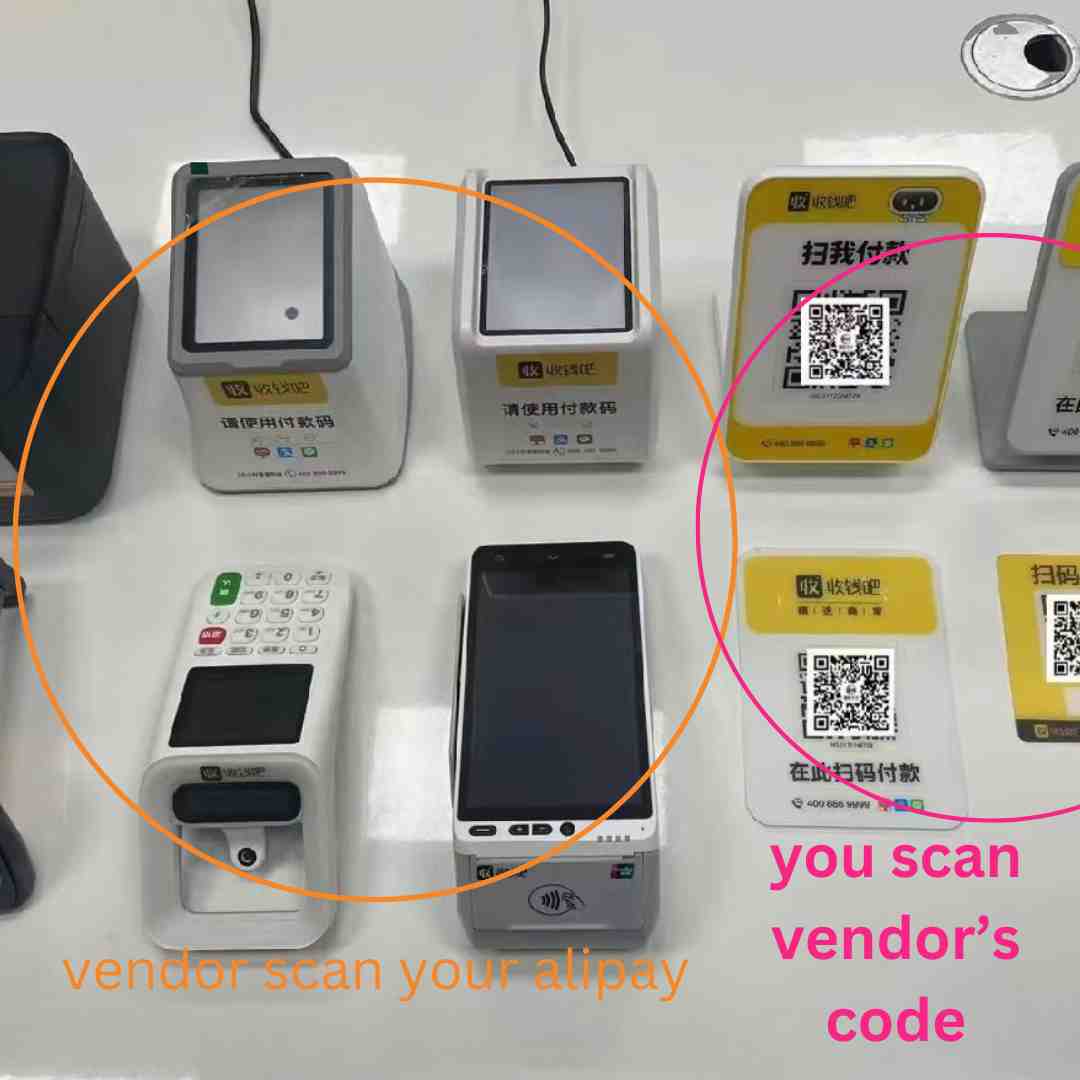

Two ways to make payment using Alipay account: if you see payment tools as in the left circle, the merchants will scan your QR code; if you see the vendor’s QR code as in the right circle, you scan the merchant’s QR code:

The merchant scans you:

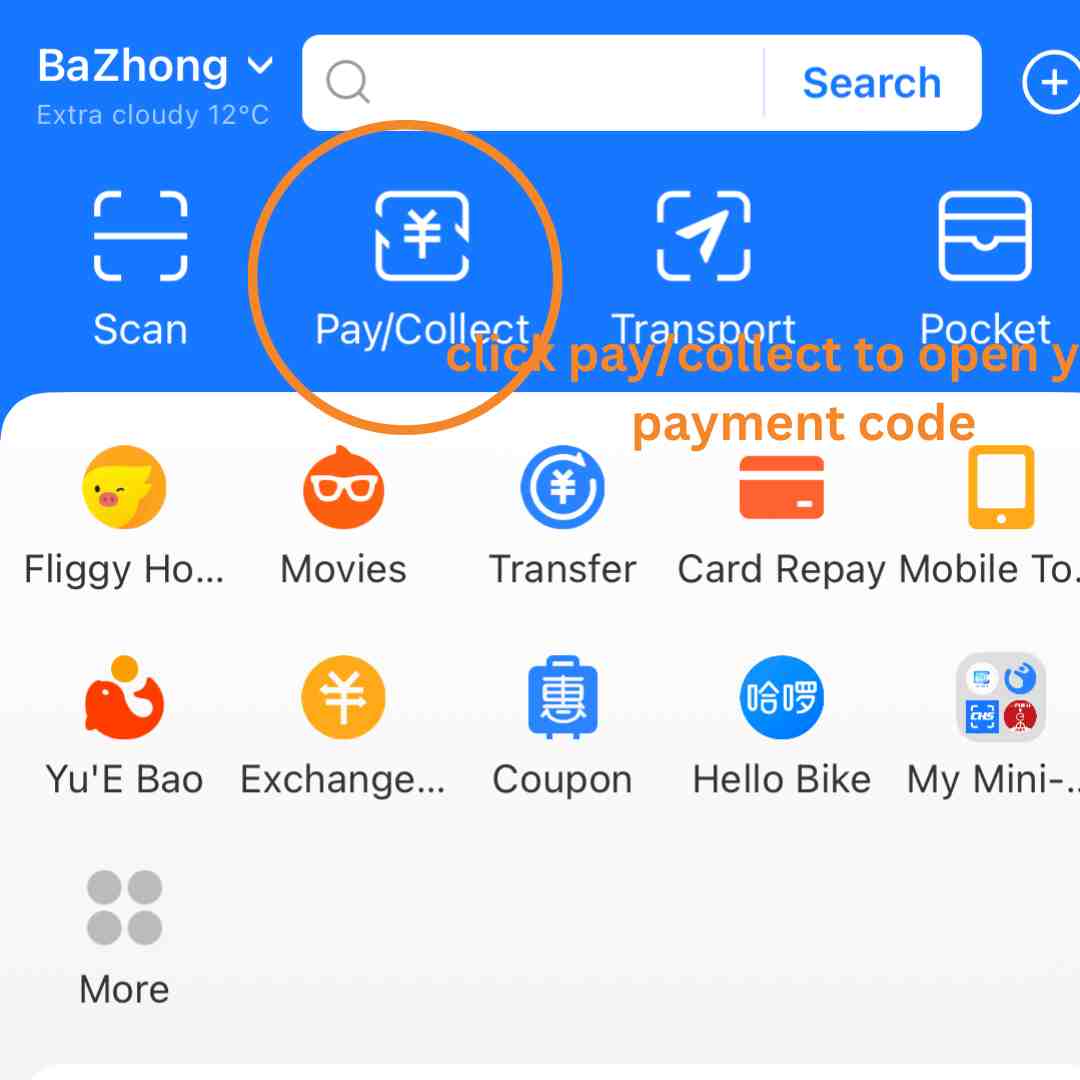

- Open ‘Pay/Collect’ tab on top of Alipay account:

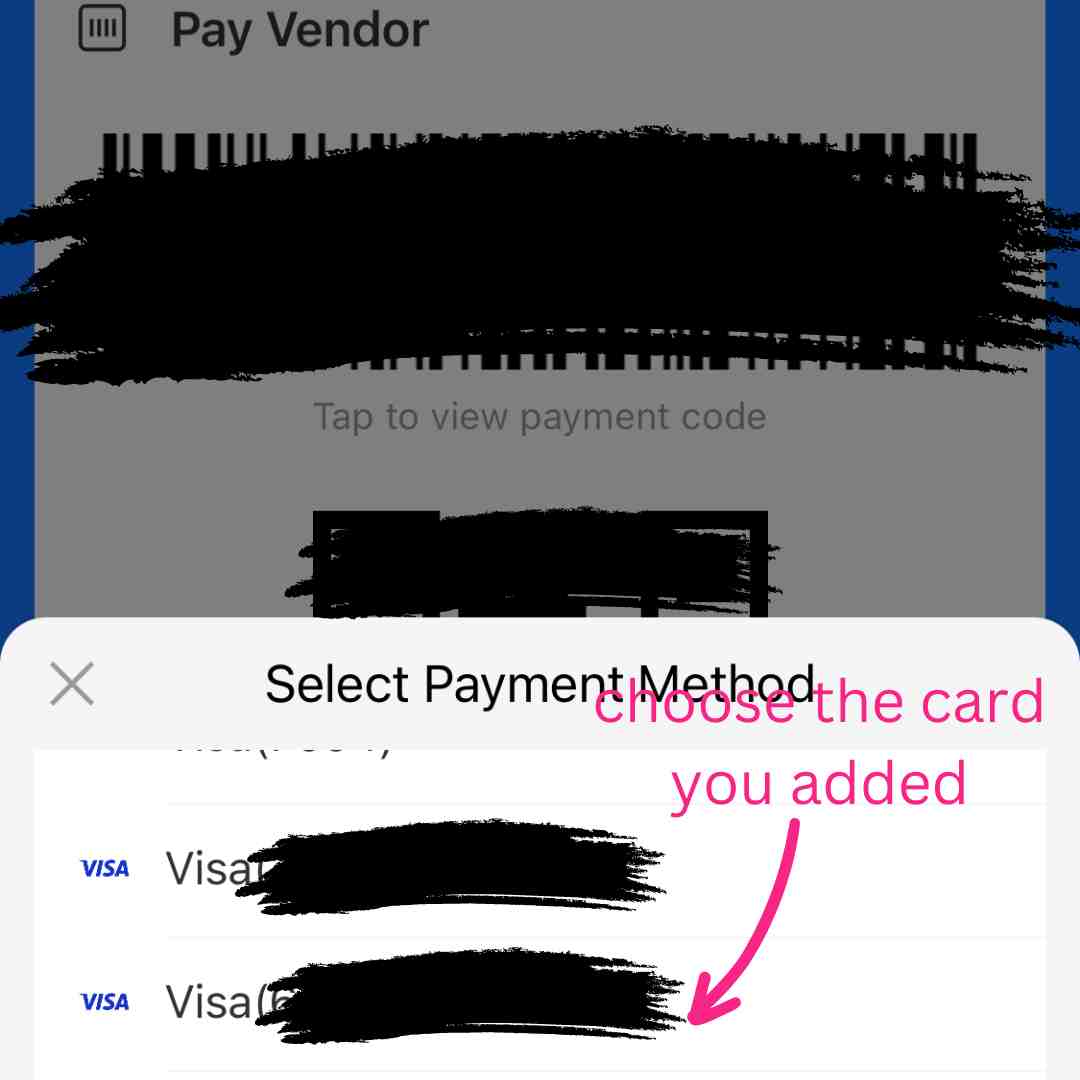

- Select your preferred mobile payment method (the card you just linked in the above section)

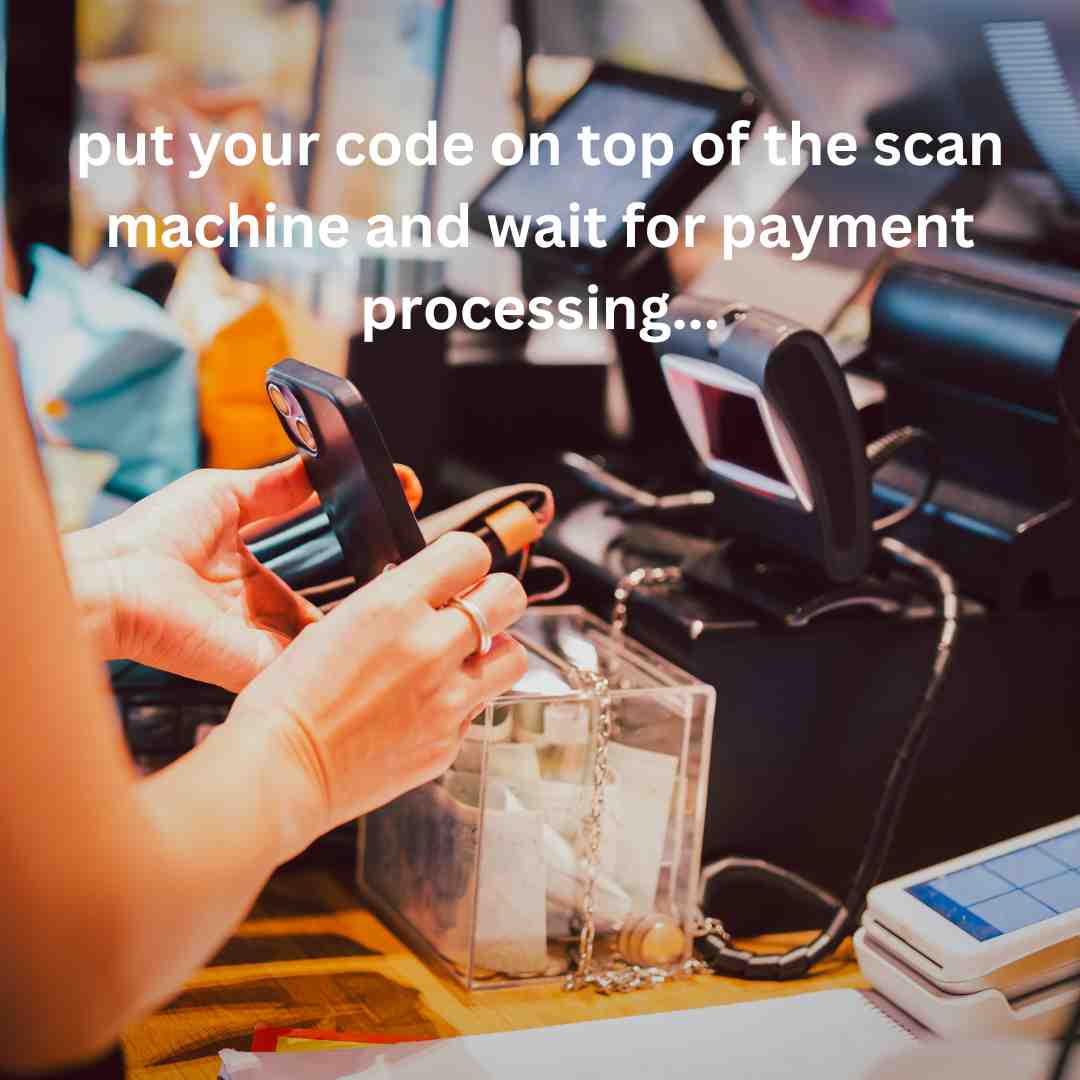

- Put your QR code above the scanning tool

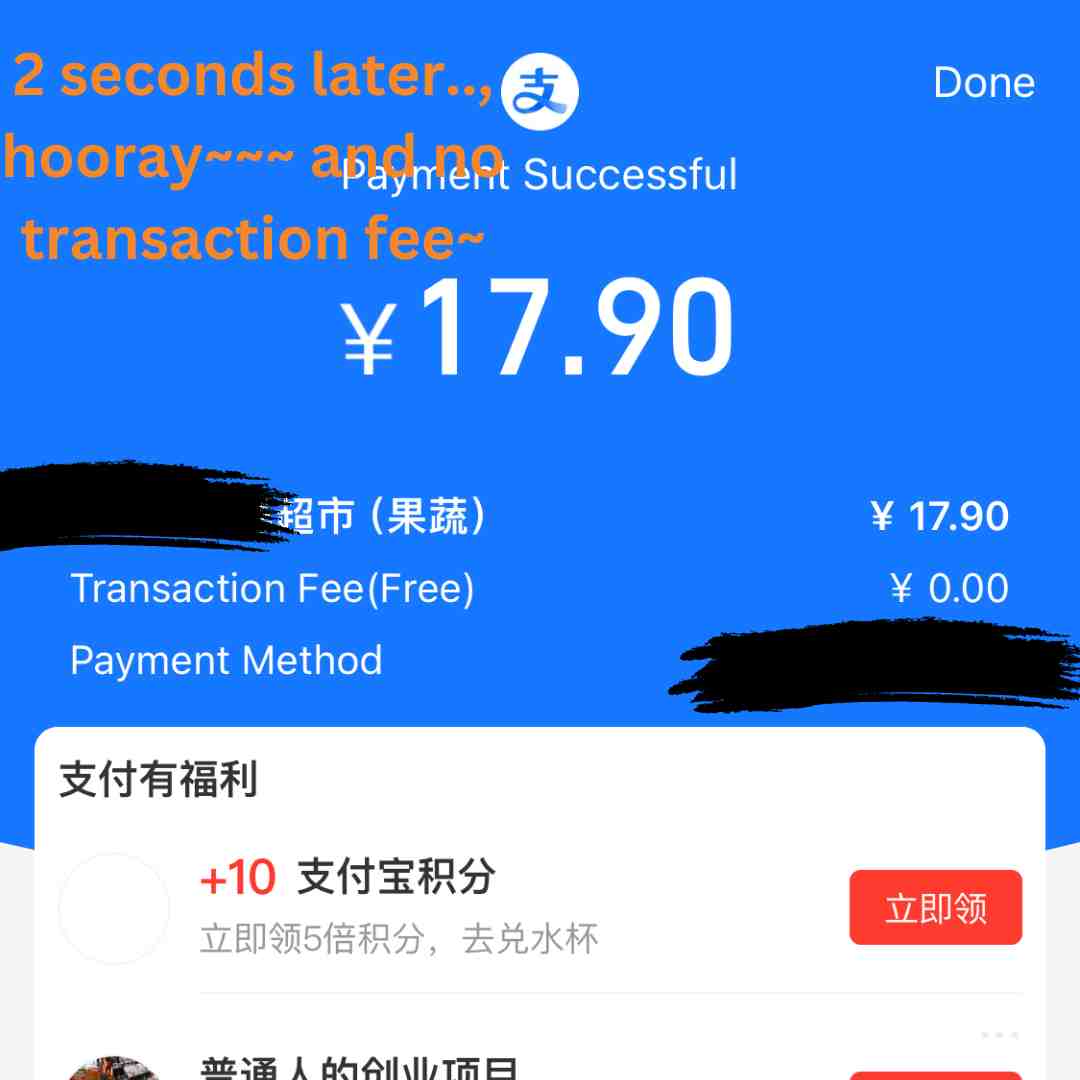

- Waiting for about 2 seconds…. hooray, payment successful and it is in Chinese yuan!

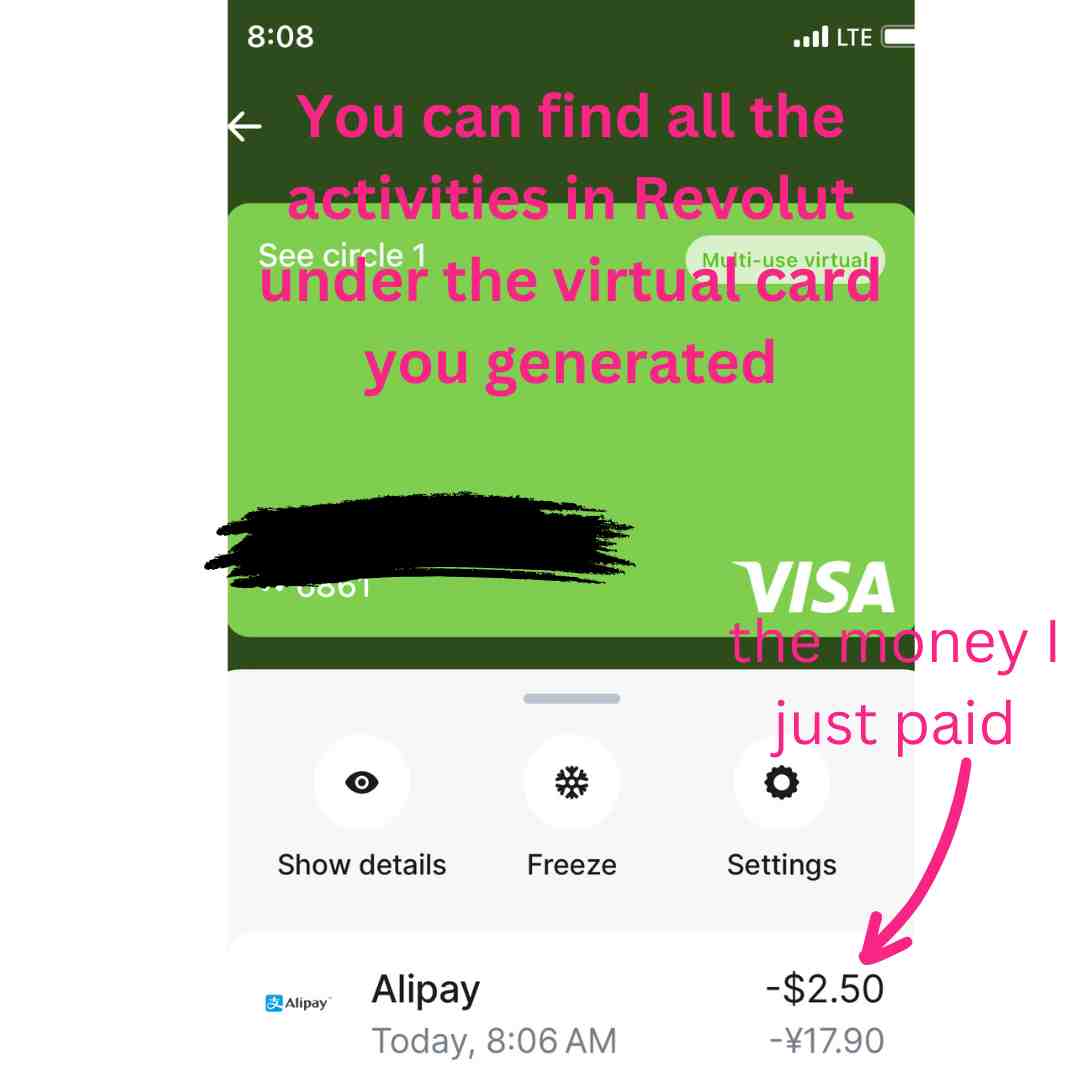

- Revolut shows all the payment activities instantly:

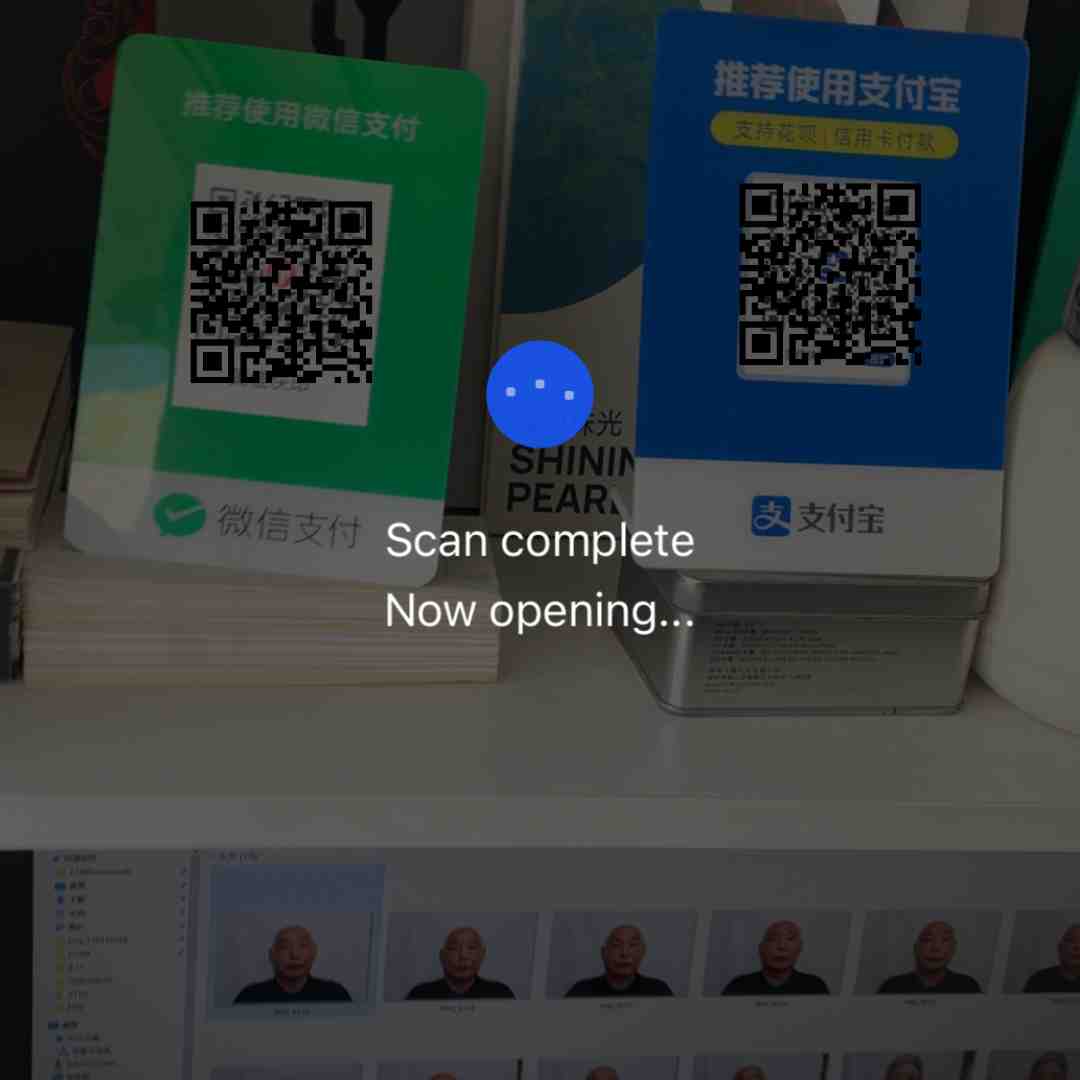

You scan the merchant:

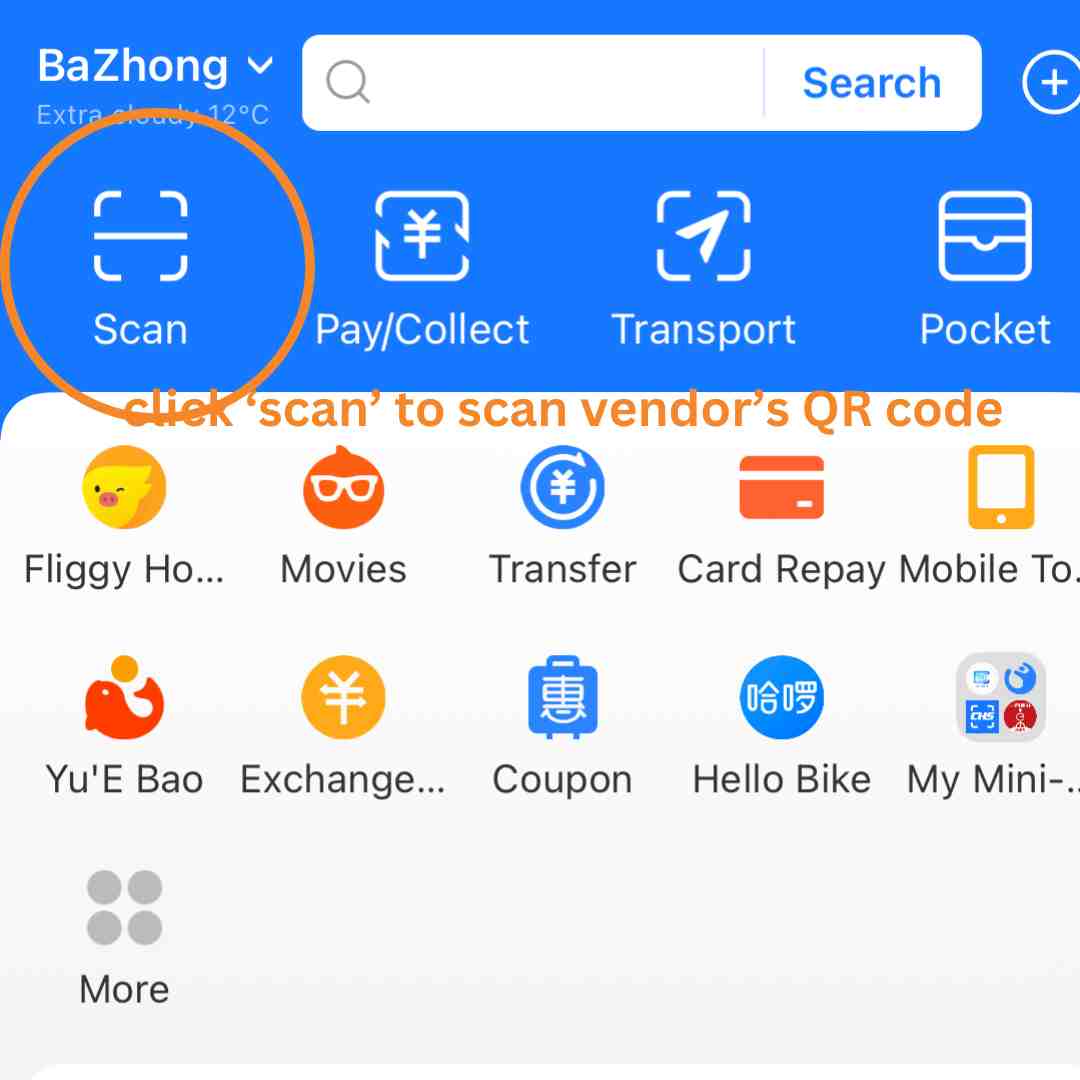

- Open your Alipay account and click ‘Scan’

- Wait for 3 seconds for processing

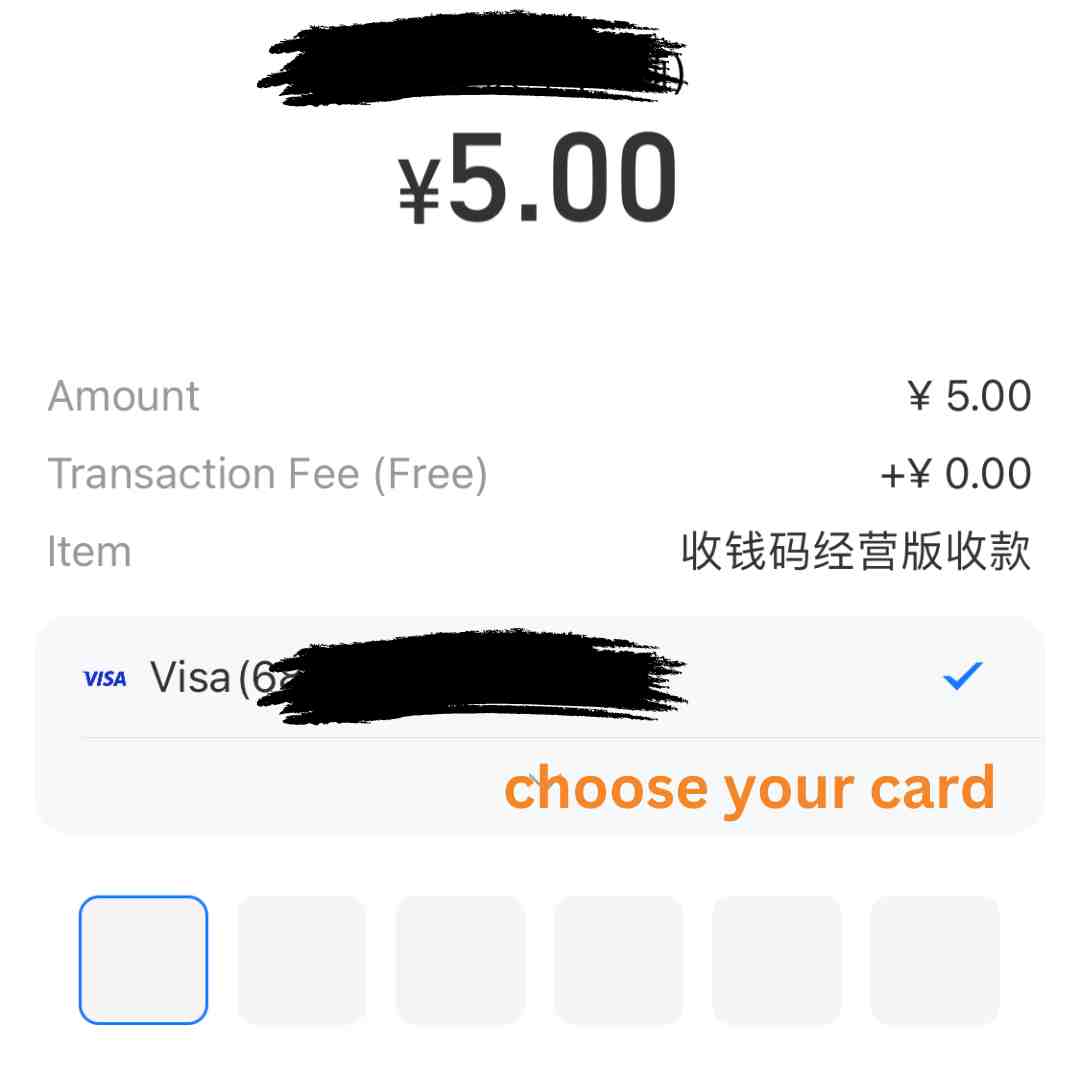

- Select your credit or debit card

- Payment successful, Revolut sent me notification instantly:

At the same time, you can also use it to take public transportation such as subways and buses.

Alternative Payment Method for Expat in Shanghai

Alternatives such as physical credit card, ATMs, WeChat payment can be used.

- Physical credit card: For most big vendors support visa/master card in China, but most small vendors do not support credit card. Revolut provide physical credit card with following outstanding features specifically for global transactions:

- Robust security features for funds and personal information protection

- Multi-currency supports where I can spend money abroad in the local currency without incurring high foreign transaction fees

- Global Spending and Withdrawal: The Revolut physical card can be used worldwide, wherever Visa or Mastercard (depending on the card issuer for Revolut in your region) is accepted. Additionally, you can use the card to withdraw money from ATMs around the globe, often with favorable exchange rates and low fees.

- Withdraw Cash in Shanghai: To ensure you have access to cash during your stay in Shanghai, ATMs are a reliable option. Most major ATMs, such as ICBC, CBC, and BOC, accept foreign bank cards.

- Similar to Alipay, WeChat Pay for foreigners also requires passport verification for foreigners to use their payment services. However, signing up WeChat and binding international cards may be challenging.

They might not quite replicate the Alipay experience, but they certainly help bridge the gap for foreigners dealing with Chinese transactions. As we embrace an increasingly interconnected world, who knows? Maybe sometime soon, we’ll enjoy a truly global payment solution that cuts across borders and nationalities.

Bottom Line

Please note that this information is based on the latest update from the website as of March 17, 2024, and the process may vary slightly depending on your location and the specific requirements at the time of your application.