In today’s digital era, navigating the complexities of online Chinese payment systems requires familiarity with the leading platforms: Alipay vs WeChat Pay. These platforms have revolutionized the way transactions are conducted, offering unparalleled convenience and flexibility to both local and international users.

As we delve into the intricacies of signing up, making payments in China, and understanding the nuances of these services, it becomes evident how Alipay vs WeChat Pay have become indispensable tools in the digital payment landscape, particularly for expatriates seeking to adapt to China’s digital economy.

Alipay:

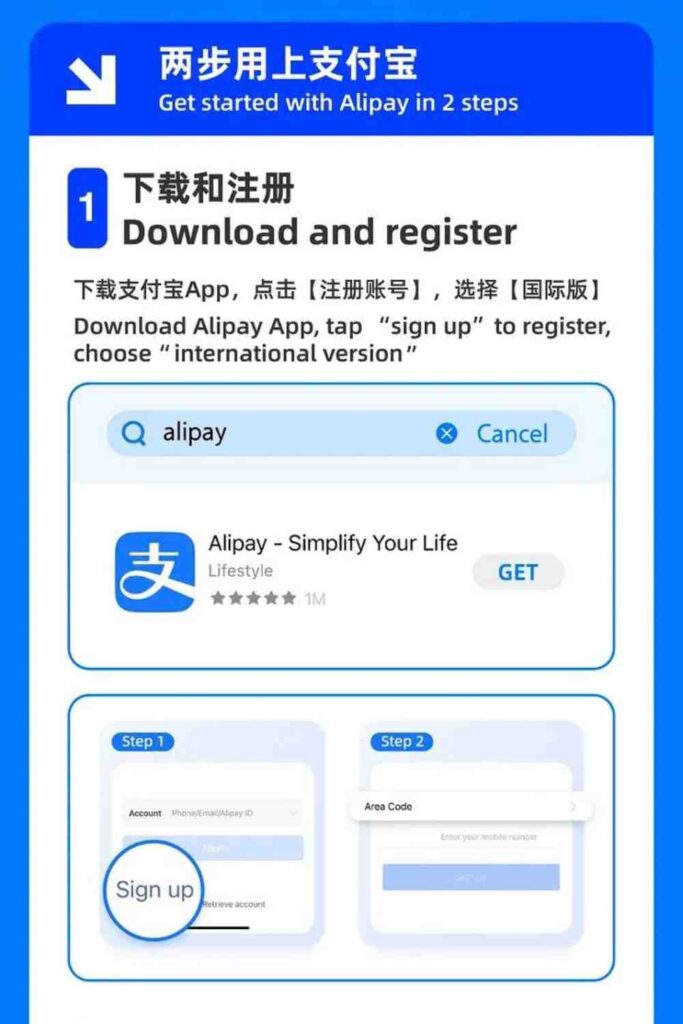

To begin using Alipay, follow these simple steps or check our detailed guide on signing up Alipay:

- Downloading and Registering on Alipay:

Begin by downloading Alipay from the App Store or Google Play Store. Registration is straightforward and can be completed using your mobile number.

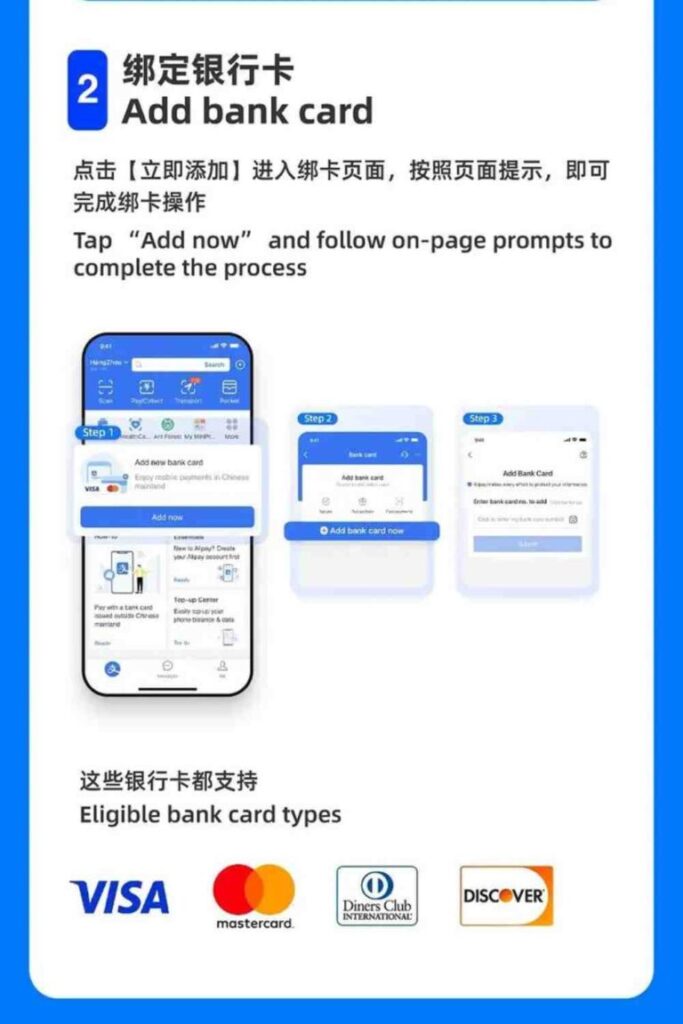

Alternatively, you have the option to register using your email or Apple account, offering flexibility in the signup process. - Binding a Bank Card:

Alipay supports the addition of overseas bank cards issued by all the major international card networks, including Visa, Mastercard, Diners Club International, and Discover.

This feature makes it convenient for international users to link their bank accounts and engage in transactions seamlessly. - Making Payments:

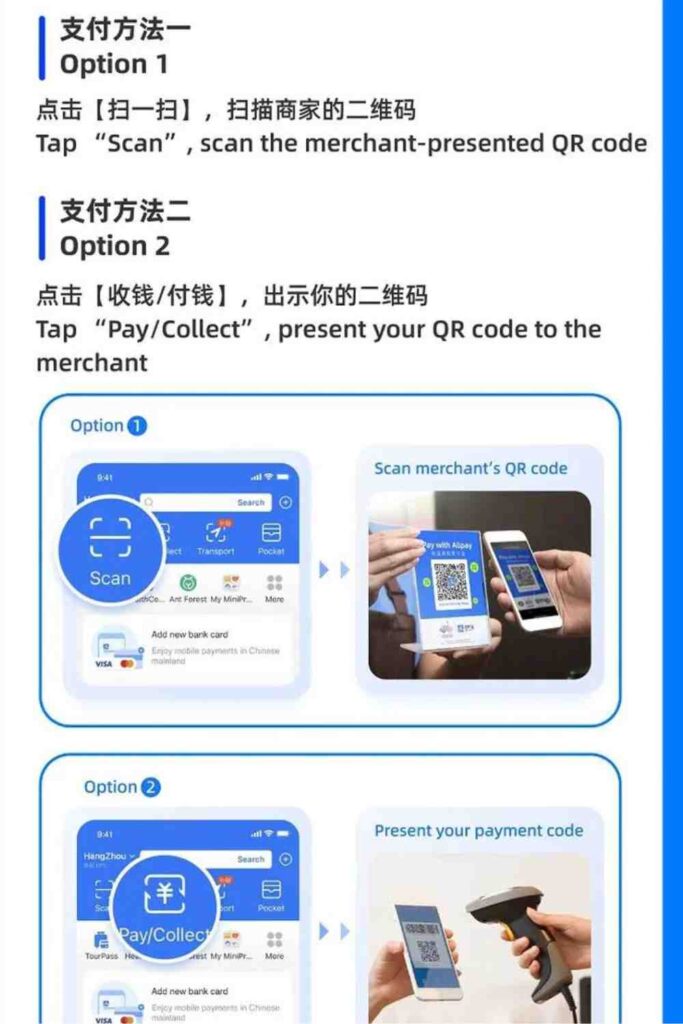

Alipay enables users to make payments by scanning a merchant’s QR code or presenting your Alipay QR code for scanning.

Additionally, Alipay facilitates the use of public transportation, such as subways and buses, by allowing payments through the app, enhancing convenience for users on the go.

微信 or WeChat:

When using the WeChat pay, know that:

- App Uniformity Across Regions:

Regardless of whether you download it from the mainland’s App Store or an overseas region, the WeChat app remains the same.

The app distinguishes its functions based on the account’s region, with the deciding factor being the user’s phone number.

Accounts tied to a Chinese mainland phone number will access Weixin, while those with an overseas phone number will use WeChat. - Account Transferability:

Changing the phone number associated with your account allows for a seamless transition between Weixin and WeChat.

For instance, switching from a mainland number to an overseas number automatically transitions your account to WeChat, subject to terms and conditions. - Signing Up for WeChat:

To sign up, download WeChat, select your region, and provide your phone number, nickname, and password. Account verification requires assistance from an existing WeChat user.

Following verification, a text message will guide you through the completion of registration.

Making Payments: Alipay vs WeChat Pay

Both Alipay and WeChat pay support linking international credit cards: check these two posts WeChat payment for foreigners and Alipay for Foreigners to bind your international bank cards, extending their convenience to overseas Chinese without domestic bank cards. This development makes it significantly easier for users to consume services while visiting the country, despite the inability to link foreign debit cards.

Transaction Fees

Alipay vs WeChat Pay implements a fee structure for transactions exceeding 200 RMB, charging a 3% fee on the total amount of such transactions. However, this fee is refunded in the event of a transaction refund, ensuring fairness.

Transfer

- Alipay:

The simplest transfer method involves exchanging money with a Chinese acquaintance or friend, who can then transfer the balance to you via Alipay. However, transfers require a Chinese bank card linked to Alipay. - WeChat:

Unlike Alipay, WeChat mandates the binding of a domestic debit card for transfers, restricting the ability for Chinese friends to transfer money to your WeChat account without one.

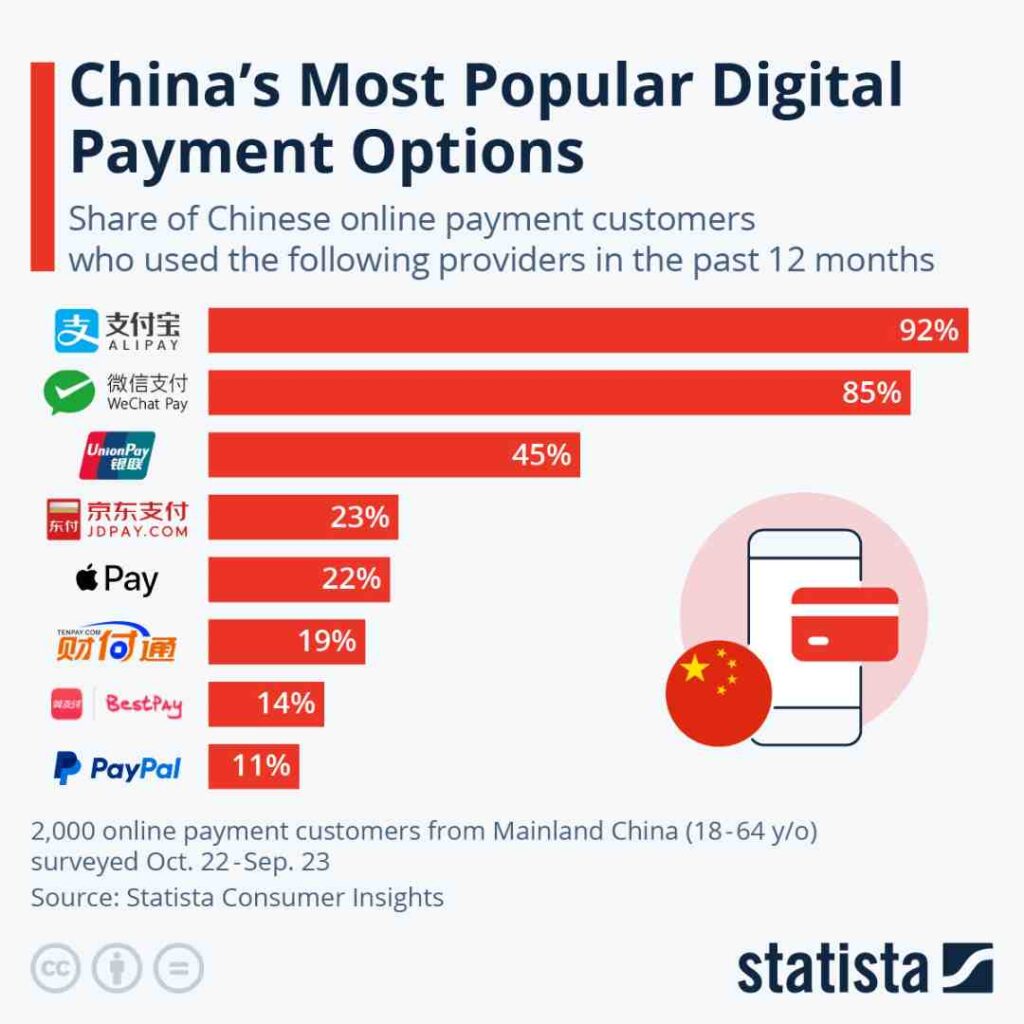

Data about Alipay vs WeChat Pay

According to Statista Consumer Insights, Alipay WeChat Pay led as the most favored digital payment service in China for 2023, capturing the preference of approximately 90% of the country’s online payment users over the past year.

UnionPay follows, utilized by 45% of participants, thanks to its connection with a significant, state-owned bank card network. Remarkably, nearly 70% of those surveyed in China reported using mobile payments frequently.

The digital payment landscape in China is also enriched by contributions from major tech entities such as JD.com, Tencent, and Huawei, alongside state-owned China Telecom’s BesTV.

Notably, Apple and PayPal, two international brands, have made significant inroads, with Apple achieving a 22% penetration rate, an increase from the previous year’s 19%, and PayPal securing the 8th spot with 11% usage among online payment customers.

Reflecting on trends from as far back as 2019, Statista’s survey indicated a consistent reliance on digital payment methods for both online shopping and physical store transactions among Chinese consumers, with 60% using digital financial services daily.

This pattern is mirrored in India, where digital payments facilitate in-store purchases and food orders, showcasing a preference for booking ahead before collecting orders from restaurants and cafes.

Alternative Payment Methods for Expats in China

- TourCard:

Designed for international tourists, TourCard offers a mobile payment option through vendors accepting UnionPay, albeit Tourcard does not work for most of the people now and it has the limitations and a 5% transaction fee. - Swapsy for US Citizens or Visa Holders:

Swapsy emerges as a practical currency exchange platform between USD and CNY, boasting a transaction fee of less than 1%, appealing for its affordability. - VPayFast:

VPayFast offers a versatile payment solution accepting various payment methods, accessible to users irrespective of citizenship, albeit at a higher cost.

Wrapping Up Alipay vs WeChat Pay

Alipay vs WeChat Pay stand as pillars of the digital payment ecosystem in China, offering a comprehensive array of services that cater to the diverse needs of users. From signing up to managing transactions and exploring alternative payment methods for expatriates, these platforms embody the fusion of convenience, innovation, and accessibility.